DOI:https://doi.org/10.34069/AI/2021.44.08.12

The competitiveness evaluation of milk trademarks on the market of Chelyabinsk region

ОЦЕНКА КОНКУРЕНТОСПОСОБНОСТИ ТОРГОВЫХ МАРОК МОЛОКА, РЕАЛИЗУЕМОГО НА РЫНКЕ ЧЕЛЯБИНСКОЙ ОБЛАСТИ

Evaluación de la competitividad de las marcas de leche realizadas en el mercado de la región de Chelyabinsk

Abstract

The milk market in the quarantine conditions associated with the pandemic and the spread of COVID-19 is going through a difficult period, superimposed on a number of pre-existing problems. In particular, the production of raw milk by agricultural producers is growing, while this contradicts the fact that the consumption of milk in the country is falling, and incomes of the population are decreasing. All these factors lead to increased competition in the drinking milk market and determine the relevance of the issues of studying its competitiveness, especially in a specific regional market. Today there is a lack of a comprehensive scientific understanding of methods for assessing the competitiveness of drinking milk presented on the local market. As the purpose of the study, the article stated the assessment of the competitiveness of drinking milk brands, the most common in the market of Chelyabinsk region. As a result of scientific research, a quantitative expert assessment of quality was determined and an assessment of competitiveness from a professional objective point of view was carried out by taking into account the quality per unit of money paid. The result of the study was the development of recommendations separately for different target audiences, who can benefit from the results of the study: consumers, retailers and manufacturers.

Keywords: drinking milk, competitiveness of milk, price and quality of milk, assessment of the competitiveness of milk.

Аннотация

Рынок молока в условиях карантина, связанного с пандемией и распространением COVID-19, переживает сложный период, накладывающийся на целый ряд ранее существовавших проблем. В частности, производство сырого молока сельскохозяйственными производителями растет, при этом в противоречии с этим вступает тот факт, что потребление молока по стране падает, сокращаются доходы населения. Все эти факторы приводят к усилению конкуренции на рынке питьевого молока и обуславливают актуальность вопросов изучения ее конкурентоспособности, особенно на конкретном региональном рынке. Сегодня не хватает комплексного научного понимания методик оценки конкурентоспособности молока питьевого, представленного на локальном рынке. В качестве цели исследования в статье была заявлена оценка конкурентоспособности молока питьевого торговых марок, наиболее распространенных на рынке Челябинской области. В результате научного исследования определена количественная экспертная оценка качества и проведена оценка конкурентоспособности с профессиональной объективной точки зрения путем учета качества за единицу уплаченных денежных средств. Итогом исследования стала выработка рекомендаций отдельно для разных целевых аудиторий, которым могут быть полезны результаты исследования: потребителям, розничным торговым предприятиям и производителям.

Ключевые слова: питьевое молоко, конкурентоспособность молока, цена и качество молока, оценка конкурентоспособности молока.

Resumen

El mercado de la leche en las condiciones de cuarentena asociadas a la pandemia y la propagación del COVID-19 atraviesa un período difícil, superpuesto a una serie de problemas preexistentes. En particular, la producción de leche cruda por parte de los productores agrícolas está creciendo, mientras que esto contradice el hecho de que el consumo de leche en el país está disminuyendo y los ingresos de la población están disminuyendo. Todos estos factores conducen a una mayor competencia en el mercado de la leche de consumo y determinan la relevancia de los temas de estudio de su competitividad, especialmente en un mercado regional específico. Hoy en día existe una falta de una comprensión científica integral de los métodos para evaluar la competitividad de la leche de consumo presentada en el mercado local. Como propósito del estudio, el artículo planteó la evaluación de la competitividad de las marcas de leche de consumo, las más comunes en el mercado de la región de Chelyabinsk. Como resultado de la investigación científica, se determinó una evaluación cuantitativa de la calidad por parte de expertos y se llevó a cabo una evaluación de la competitividad desde un punto de vista objetivo profesional teniendo en cuenta la calidad por unidad de dinero pagada. El estudio dio como resultado el desarrollo de recomendaciones por separado para diferentes públicos objetivo que pueden beneficiarse de los resultados de la investigación: consumidores, minoristas y fabricantes.

Palabras claves: leche de consumo, competitividad de la leche, precio y calidad de la leche, evaluación de la competitividad de la leche.

Introduction

Milk is one of the most ancient food products of animal origin, while it doesn’t lose its importance in the daily diet of the population today. However, the dairy subcomplex and the milk market are not going through the easiest times during the coronavirus crisis. According to O. I. Katlishin, the production of whole milk in commercial farms in recent years has been characterized by an upward trend due to favorable external economic conditions of the food embargo and solid government support measures for the dairy industry (Katlishin, 2018). A.V. Popova and G.V. Bykovskaya note that as a result of production growth, retail trade networks offer consumers a large volume of the widest assortment of drinking milk of various brands, in various packaging, various degrees of fat content, etc. (Popova, & Bykovskaya, 2016)

Already in 2019, the consumption of dairy products in terms of milk in the Russian Federation decreased by 0.5%. At the same time, A. E. Surinov focuses on the fact that in the context of the economic crisis caused by the pandemic, the main factor determining the volume of consumption of dairy products is the stagnation of income of the population, and by the end of 2020, the volume of consumption of dairy products may sink even more (Surinov, 2019). It is also worth considering that milk is a perishable product with a limited period of sale, and the profit of both the seller's and the manufacturer's company largely depends on the degree of its competitiveness. All these factors lead to increased competition in the dairy market and determine the relevance of the issues of studying its competitiveness.

In this article, the competitiveness of milk, following I. V. Vasilieva, is understood as a complex of quality and price-forming characteristics that reflect the advantages or disadvantages of a particular brand of drinking milk, determined by various methods (Vasilieva, 2016).

Literature review

Russian scientists V. V. Khaidukov, N. E. Astashova, & D. V. Kozlenko (Khaidukov, Astashova, & Kozlenko, 2021), D. S. Voronov (Voronov, 2015), I. N. Burobkin, E. M. Dusaev (Burobkin, & Dusaev, 2004), A. I. Kolobova, O. A., Kosintseva (Kolobova, & Kosintseva, 2010), A. A. Volodkina, Zh. V. Domozhilkina (Volodkina, & Domozhilkina, 2016), N. M. Morozov, Yu. A. Tsoi, V. V. Kirsanov, N. G. Bakach, V. I. Perednya (Morozov, Tsoi, Kirsanov, Bakach, & Perednya, 2018), B. M. Dvinsky, & A. I. Grinevich (Dvinsky, & Grinevich, 2015), I. M. Lifits (Lifits, 2001).

Scientists B. M. Dvinsky, A. I. Grinevich express the scientific point of view that milk is the food records for the content of complete proteins, fats, phosphatides, mineral salts and fat-soluble vitamins, and in total about one hundred substances that are very important from a biological point of view is found in milk (Dvinsky, & Grinevich, 2015). Based on quality and other characteristics, drinking milk is considered competitive on the market, having a complex of attractive consumer, quality and cost properties, which, in the context of a wide supply, ensure the satisfaction of buyers' needs and commercial success of commodity producers. According to V. V. Khaidukov, N. E. Astashova, & D. V. Kozlenko, economic aspects of the competitiveness of drinking milk depend on the ability of a particular commodity producer to produce a competitive product, the characteristics and quality of which, in comparison with analogue products, determine its market success, both in the domestic and foreign markets (Khaidukov, Astashova, & Kozlenko, 2021).

In assessing the indicators of the competitiveness of a product, two sides interact: on the one hand‒ consumers, on the other hand ‒ commodity producers. The value of the same indicator can satisfy the buyer and be completely unacceptable for the manufacturer. If we compare the first 10 months of 2018 and 2019, then we can note an increase in import volumes by 14%. According to D. S. Voronov’s estimates, the annual import volume in terms of milk equivalent should have grown by 10% and amounted to 7.0‒7.1 million tons (Voronov, 2015).

There are several methods for assessing competitiveness, used in practice of enterprises or proposed by some authors as scientific developments. I. N. Burobkin, E. M. Dusaev distinguish three main methods: 1) systemic; 2) process; 3) situational (Burobkin, & Dusaev, 2004). The most common method for assessing the competitiveness of a product is the index method, the essence of which is the ratio of product quality to its price. The higher the quality and lower the price, more competitiveness is. The index method is considered to be the most effective by A. I. Kolobov, O. A. Kosintsev (Kolobova, & Kosintseva, 2010), N. M. Morozov, Yu. A. Tsoi, V. V. Kirsanov, N. G. Bakach, V. I. Perednya (Morozov, Tsoi, Kirsanov, Bakach, & Perednya, 2018).

The differential method is based on the use of single parameters of the analyzed product and the comparison base and their comparison. In most cases, the differential method allows only stating the fact of the competitiveness of the analyzed product or its shortcomings in comparison with the analogue product. It doesn’t take into account the influence of each parameter on consumer preferences when choosing a product. To eliminate this drawback, I. M. Lifits uses a comprehensive method for assessing competitiveness (Lifits, 2001).

A comprehensive method for assessing the competitiveness of a product is based on the use of complex indicators or a comparison of specific beneficial effects of the analyzed product and the sample. A complex indicator for technical parameters is the sum of the products of technical parameters and their weightings. To determine the significance of each technical parameter in the general set, expert estimates based on the results of marketing research are used. This complex indicator characterizes the degree of compliance of a given product with the existing need for the entire set of technical parameters.

The above methods for assessing the competitiveness of a product are commonly used and are often found in domestic literature. They meet the requirements of the modern information economy, maintaining the efficiency of the functioning of food enterprises.

Materials and methods

The aim of the study is to assess the competitiveness of drinking milk brands, the most common in the market of Chelyabinsk region. Achievement of this goal was carried out through the solution of the following tasks: 1) identification of competitiveness, taking into account the price and quality of drinking milk samples; 2) assessment of the competitiveness of milk using a complex integrated indicator and the development of recommendations for retail chains to improve the assortment matrix and for producers to increase the level of competitiveness of the studied milk brands.

The object of scientific research is the competitiveness of drinking milk with a mass fraction of 3.2% fat, sold on the market of Chelyabinsk region. The subject of this research was the quality, price and other factors of the competitiveness of milk.

The methodological and informational basis for the study were scientific articles on this topic, regulatory documents, as well as relevant Internet resources.

When carrying out the work, the following methods were used: monographic, analytical, organoleptic, sociological survey method, as well as such marketing research methods as determining the price / quality ratio and the integrated indicator of competitiveness.

There are many methods for assessing the competitiveness of dairy products: express methods (calculated by experts qualimetrically as the sum of points); graphic methods (graphs, diagrams, "radars" of competitiveness are used, visualizing the assessment of the competitiveness of a product); calculation of integrated and complex indicators.

The research was carried out in three stages: 1) selection of milk trade samples presented on the market of Chelyabinsk region; 2) determination of the competitiveness of milk by the price-quality method; 3) determination of a complex (integrated) indicator of competitiveness based on the study of consumer preferences.

During the first stage, samples of drinking milk «First taste» (sample № 1), «Podovinnovskoye milk» (sample № 2), «Chebarkul milk» (sample № 3), «New day» (sample № 4) were collected. To comply with the requirements for the typical and representativeness of the study, milk samples were selected for identical characteristics from a homogeneous group of dairy products: volume ‒ 1000 ml, type of packaging ‒ tetra-pack, pure-pack; mass fraction of fat 3.2%.

Based on preliminary studies on the quality of selected milk samples, which are one of the stages of an end-to-end comprehensive scientific study and are not included in the content of this article (direct studies of the organoleptic and physicochemical indicators of the quality of milk samples were carried out not by the authors of the article, but in a special expert laboratory of Perm State Agro-Technological University named after Academician D.N. Pryanishnikov), their quantitative expert assessment of quality was carried out. In the course of the work, a point assessment of the organoleptic and physicochemical indicators of the quality of the studied milk samples was carried out. The experts were asked to evaluate the following indicators of the studied milk samples on a five-point scale: appearance, consistency, taste and smell, color, density of milk, its acidity, mass fraction of fat, content of dry skim milk residue and purity group.

The appearance and color of milk should be an opaque white liquid. The consistency should be liquid, homogeneous, not viscous, without flakes. Taste and smell characteristic of milk, without foreign tastes and odors, with a slight aftertaste of boiling. The density of pasteurized milk was determined by measuring the volume of the analyzed sample and the mass of the hydrometer floating in it. Acidity was determined in Turner degrees, which should not be more than 21 ° T. The proportion of fat was determined by an acid method based on the separation of fat from milk, under the action of concentrated sulfuric acid and isoamyl alcohol, followed by centrifugation and measurement of the volume of released fat in the graduated part of the butyrometer. Milk solids were determined after drying, purity was determined by the absence of mechanical impurities on the filter after filtration.

The second stage was to determine the competitiveness of milk using the price-quality method. When assessing competitiveness by the price-quality method, a quantitative expert assessment of samples of the studied brands of milk was carried out. Four experts, using a brainstorming method, collectively evaluated the above-described indicators of the studied milk samples on a five-point scale: appearance, consistency, taste and smell, color, milk density, as well as its acidity, fat mass fraction, non-fat milk solids content and purity group. When assigning marks, the data of a preliminary laboratory study were used, the collective assessment was rounded to the nearest whole, the head of the expert group had a double vote to prevent situations when adjacent marks were given by an equal number of experts (for example, two experts were assigned 4 and 5, and if the head group was among those who rated at 5, then the final mark will be five). After the point assessment, the results are adjusted taking into account the weights, after which the quantitative qualitative assessment is divided by the price, and the more quality points can be bought for one ruble, the higher the competitiveness is.

The third stage of the study was the definition of a complex (integrated) indicator of competitiveness based on the study of consumer preferences. The analysis of the competitiveness of the brands of milk on the market of Chelyabinsk region through the calculation of the integrated indicator of competitiveness was completely based on the opinion of end consumers, since the main criterion for the competitiveness of milk is the degree of satisfaction of the real needs of end customers. In the integrated calculation of the competitiveness of milk brands, the opinion of consumers about their sensory properties and other quality indicators, price, consumer packaging and labeling, and brand awareness was taken into account.

By analogy with the previous method, after analyzing consumer preferences, the results obtained are corrected taking into account the weight coefficients of the importance of competitiveness criteria for consumers, and the results obtained are summed up according to the samples. The higher the final score, the higher the competitiveness of the brand is.

When assessing competitiveness by the method of determining the ratio of price and quality, the following work was done. To calculate the complex quality indicator using the qualimetry method, the following generalized expression was used methodologically:

![]() (1)was used,

(1)was used,

where K is a complex dimensionless indicator of the quality of the goods, in points;

![]() ‒ a dimensionless value that characterizes the value of each quality indicator, in points;

‒ a dimensionless value that characterizes the value of each quality indicator, in points;

![]() ‒ intragroup weighting coefficients of the i-th quality indicators within each group of properties;

‒ intragroup weighting coefficients of the i-th quality indicators within each group of properties;

z ‒ the number of quality indicators.

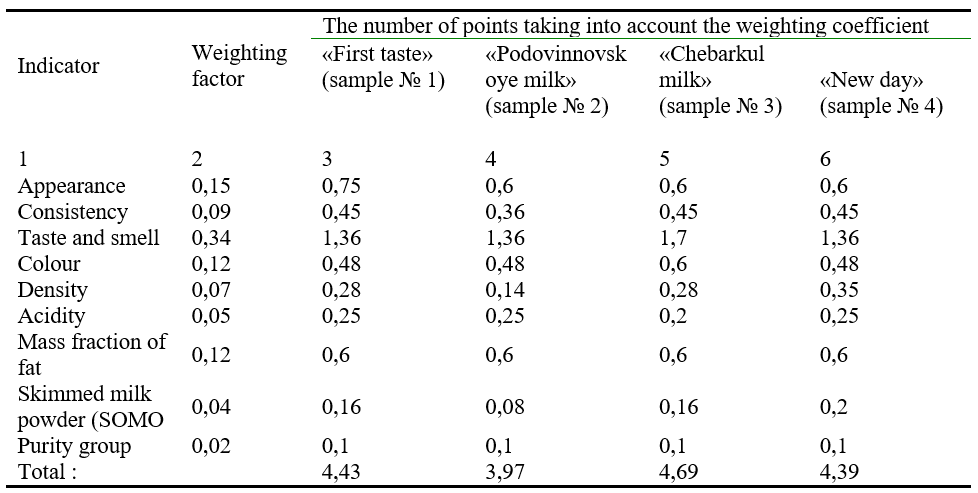

In the course of the qualimetric assessment of quality, experts determined the weighting coefficients of quality indicators, since they were clearly heterogeneous and unequal. Thus, the weight coefficient was 0.15 for the indicator of appearance, 0.09 for the indicator of consistency, 0.34 for the indicator of taste and smell, 0.12 for the indicator of color, 0.007 for the indicator of density, 0.05 for the indicator of acidity, 0.12 for the indicator mass fraction of fat, 0.04 for SOMO indicator (skimmed milk powder), 0.02 for the indicator group of purity.

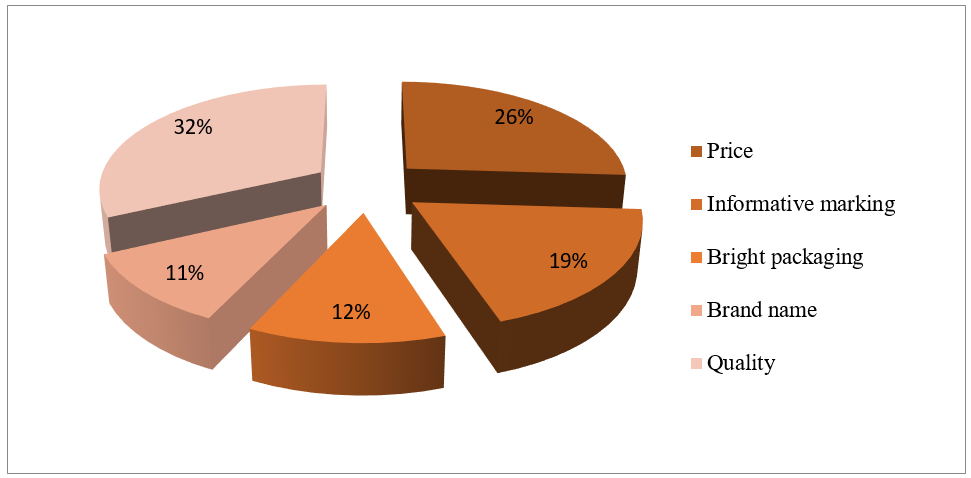

Next, a direct calculation of the ratio of milk quality, expressed in points, and its price was carried out. The higher the quality-price ratio, the higher the competitiveness of the product is. The study was carried out through a survey of end consumers, during which 100 full-fledged questionnaires suitable for processing were collected (a total of 118 people were interviewed, 18 questionnaires were spoiled). The questionnaire checklist included several standard questions on the study of gender, age and other social characteristics of the portrait of the target audience of milk consumers, as well as questions about their preferences for brands (which became the basis for choosing brands for scientific research within the framework of this article) and a question on reasons for buying a particular brand of milk. The last question was one of the key ones, it became the basis for determining the weight coefficients in a comprehensive assessment of competitiveness. The weighting factors were determined by making a proportion with respect to the mention of a specific criterion. Thus, the weighting factor should have been 0.26 for price, 0.19 for informative labeling, 0.12 for bright packaging, 0.11 for brand and 0.32 for quality.

In a direct comprehensive assessment of competitiveness, formula (1) was used in the specifics of this method, which is described in one of the scientific works of O. I. Katlishin (Katlishin, 2018).

Results and discussion

Within the framework of this article, a study of the competitiveness of the following brands of drinking milk, the most common in the local market of Chelyabinsk region, was carried out: «First taste», «Podovinnovskoye milk», «Chebarkul milk», «New day».

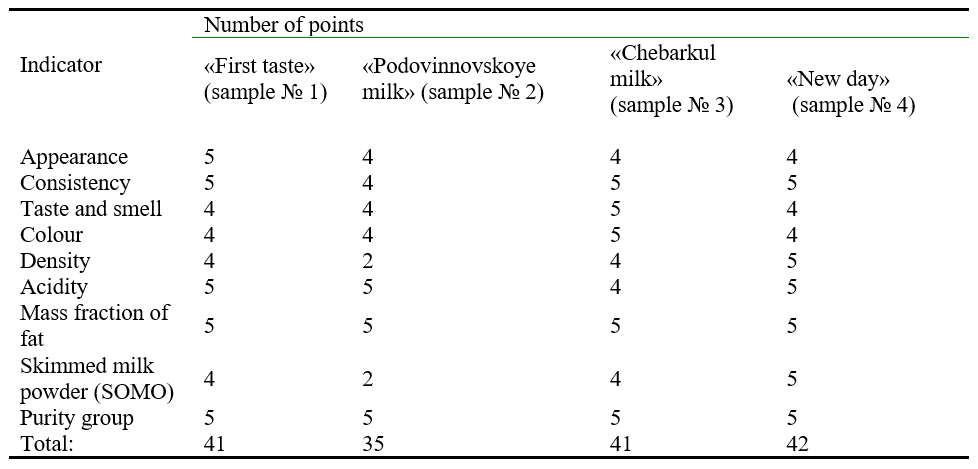

As part of solving the first task, for the purpose of assessing competitiveness by the price-quality method, a point-based expert assessment of the studied milk samples was carried out. Experts-tasters were asked to evaluate the following indicators of the studied milk samples on a five-point scale: appearance, texture, taste and smell, color, density of milk, as well as its acidity, mass fraction of fat, content of dry skim milk residue and purity group. The results of sensory evaluation of drinking milk samples are shown in Table 1.

Table 1.

Sensory assessment results.

The results of such a point rating are not final and informative, since they don’t take into account the weight, the importance of various factors in the overall quantitative assessment of quality. Therefore, the final comprehensive assessment of the quality of drinking milk samples was carried out in Table 2, taking into account the weight coefficients of its various indicators developed by experts.

Table 2.

The results of the point assessment taking into account the weighting coefficient.

Based on the calculations carried out, it can be concluded that sample 3 ‒ «Chebarkul milk» scored the highest number of points as a result of the point assessment. This sample was distinguished by a pronounced taste and smell, the color characteristic of milk was also noted, no complaints were found in terms of physicochemical indicators. Samples «First taste» and «New day» scored fewer points, but, nevertheless, are considered samples of excellent quality. «Podovinnovskoe milk» according to tasters is milk of satisfactory quality, this sample received the lowest mark. Using the above data, we calculated the quality-price ratio, which is represented in Table 3.

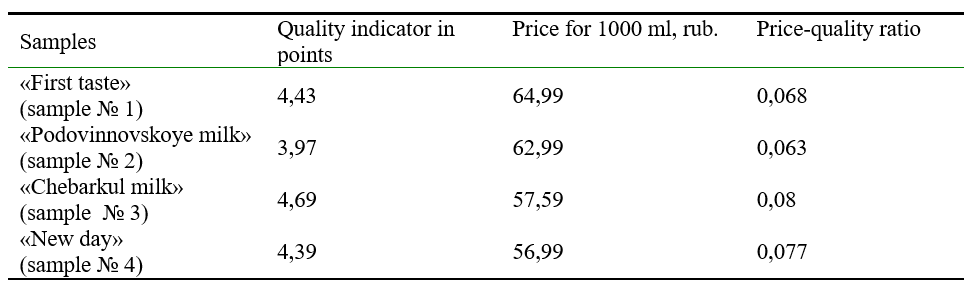

Table 3.

Quality-price ratio for milk samples

Based on the data obtained, it can be concluded that among the samples under study, sample № ‒ «Chebarkul milk» has the greatest competitiveness. This sample has excellent quality, while it is one of the most budgetary options, which confirms the ratio of quality and price. The higher this ratio, the more competitive the product is. The lowest competitiveness was noted for sample № 2 ‒ «Podovinovskoe milk». It should be noted that this sample of milk had criticism in terms of physicochemical indicators, in the expert assessment, it also received the least points from tasters, while by no means being a cheap product.

As part of solving the second task, when assessing the competitive positions of milk brands considered in the article by the method of determining the integrated indicator of competitiveness, a marketing research was carried out using the primary method of a sociological survey. During the survey, among others, the respondents were asked a question necessary to determine the weighting factor: «What influences your choice when buying milk? » The results of marketing research are displayed in Figure 1.

Figure 1. Determination of the weighting factor by interviewing respondents.

Thus, the weighting factor was 0.26 for price, 0.19 for informative labeling, 0.12 for bright packaging, 0.11 for brand and 0.32 for quality.

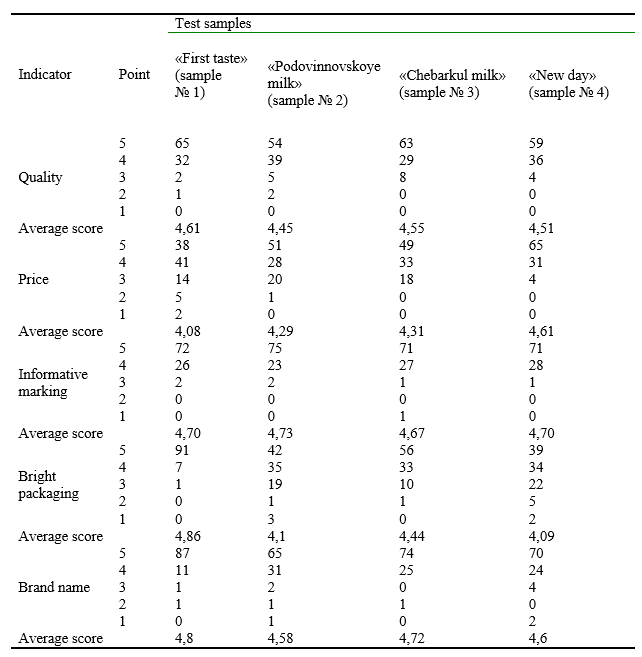

On the basis of group (summary) indicators of competitiveness, an integral indicator of the relative competitiveness of the product is determined. The integral indicator of the competitiveness of a product expresses the degree of attractiveness of a product for a buyer. All respondents were asked to assess the tested milk samples on the Likert scale. The following indicators were assessed: quality, price, informative labeling, advertising, brand. The results of the respondents' assessment of the studied milk samples according to the Likert scale are displayed in Table 4.

Table 4.

The results of the respondents' assessment of the studied milk samples according to the Likert scale.

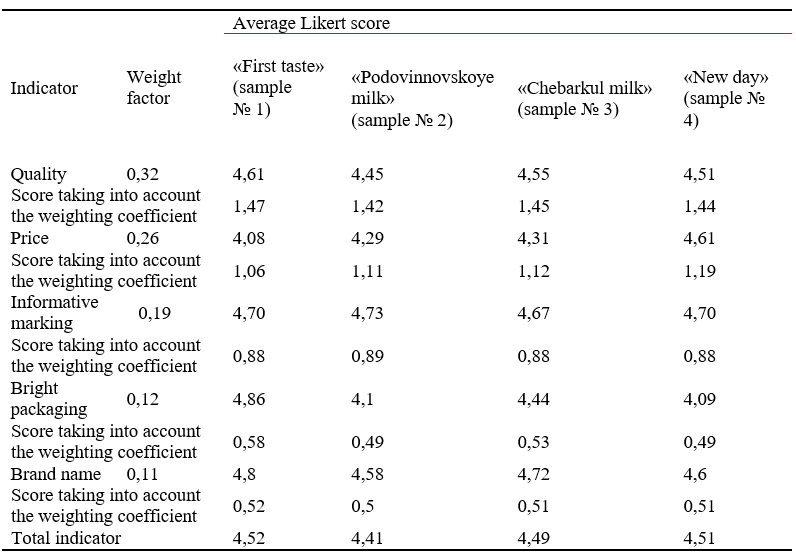

The obtained processed data from the respondents on the Likert scale are not informative, but represent a kind of surrogate that needs to be edited using weight factors. Based on the results of the table and using the weighting coefficient, an integrated assessment of competitiveness was calculated. A comprehensive integrated assessment of the competitiveness of the studied samples of drinking milk is presented in Table 5.

Table 5.

Comprehensive integrated assessment of the competitiveness of the studied samples of drinking milk.

Milk «First taste» has the highest competitiveness, the sample № 4 «New day» has a little less competitiveness with a minimum lag behind the leader, the difference with the sample №1 «First taste» was 0.01. The sample № 2 ‒ «Podovinnovskoe milk» has the lowest competitiveness, which can be caused by a number of reasons: poor-quality work of the advertising company, which led to little awareness of the brand, as well as complaints about taste characteristics, which forced the consumer to conclude about this milk as not of high quality.

Consumers rated «First taste» milk as the highest quality of the studied four brands. It should be noted that in the sensory expert assessment, sample №1 received fewer points than «Chebarkul milk», thereby it can be concluded that the opinions of one hundred interviewed respondents (unspoiled questionnaires accepted for work) and the opinions of experts participating in the professional assessment are significant differ. This fact confirms the judgment that the quality-price ratio doesn’t fully reflect the real market competitiveness of the product.

The Sample № 4 has the most attractive price - drinking milk «New Day» (56.99 rubles per liter). Here the opinion of the surveyed consumers as a whole reflects, albeit somewhat subjectively, the prevailing market conditions.

The most informative labeling, according to the respondents, was sample № 2 «Podovinovskoe milk». We can certainly state that this is the only advantage of this sample, since the labeling contained additional information on the benefits of milk, why, most likely, this sample received the highest score, unlike other samples.

The most recognizable brand with popular advertising is sample № 1 «First taste», which largely determined its leadership in the final results of the study on the integrated assessment of competitiveness. In modern society, such a marketing move as advertising is a powerful weapon in the market for competition of goods. A brand, as a guarantee of product recognition, also affects the demand for recognizable brands.

Russian scientists V. V. Khadykov, N. E. Astashova, D. V. Kozlenko, who are leading a group of researchers on agricultural competitiveness, have formulated the competitiveness of a product as a degree of actual or potential satisfaction. They have a specific need compared to similar goods on the market (Khaidukov, Astashova, & Kozlenko, 2021). This definition is almost verbatim accepted by I. Dimitrakaki, who specifies competitiveness in a set of consumer and cost characteristics linked to the specific market and time (Dimitrakaki, 2015).

V. V. Khaidukov, N. E. Astashova, D. V. Kozlenko insist that the competitiveness of the enterprise depends on the competitiveness of the goods produced, which, in turn, forms the competitiveness of the agri-food cluster, which is an important component of competitiveness in general on the world market (Khaidukov, Astashova, & Kozlenko, 2021). P. A. Guryanov is inclined to believe that the main negative factors in the growth of competitiveness of food and industrial enterprises are: 1) a high level of taxation; 2) lack of funds; 3) deterioration and lack of equipment; 4) insufficient demand for the products of enterprises in the domestic market (Guryanov, 2014). A. A. Kiritsa identifies the following obstacles to the development of competitiveness of agricultural products: 1) insufficient development of material and technical equipment of agricultural organizations; 2) a high degree of physical and moral deterioration of funds; 3) a low degree of implementation of new technologies in agricultural activities of enterprises (Kiritsa, 2020).

According to Professor E. P. Golubkov, when studying the competitiveness of a product, it is necessary to take into account its volatility even in one market, depending on the segment and time intervals (Golubkov, 2016).

The authors of this article are most impressed by the reasoned opinion of I. Lifits, who believes that the most adequate indicator of the competitiveness of a product reflects the choice of direct consumers (Lifits, 2018). Moreover, ordinary consumers, in fact and according to the legislation on the protection of consumer rights, are not required to be experts and professionally understand the quality and competitiveness of goods. Therefore, their choice is influenced by aggressive advertising and "promotion" of a particular brand, as well as other subjective factors.

Therefore, Stephen, G., A. Wiemerskizch understand by "competitiveness" the manufacturer's ability to adapt to the client's needs, the ability to satisfy his requirements (Stephen, & Wiemerskizch, 1998). A. I. Kolobova and O. A. Kosintseva distinguish three main features of milk competitiveness: the ability to meet the necessary needs of buyers; ensuring the consistency of price and quality; enterprise leadership (Kolobova, & Kosintseva, 2010). A. A. Volodkina, Zh.V. Domozhilkina, on the basis of their research on the competitiveness of dairy products in such a specific relatively local market as the consumer market of the Republic of Crimea, note the importance of managing both price-forming and quality characteristics of milk produced (Volodkina, & Domozhilkina, 2016).

I. N. Burobkin, E. M. Dusaev, proceeding from the importance of managing the competitiveness of produced drinking milk, emphasize the relevance and necessity of a basic assessment of its competitiveness, while noting the continuity of such a process at all stages of the life cycle (Burobkin, & Dusaev, 2004)

Based on the opinions of many studies, the authors of this article formulated their vision based on the use of methods for assessing competitiveness, first of all, by market professionals and product expertise by determining the price-quality ratio (Katlishin, 2018). The second most important author's method of assessing competitiveness is an integrated assessment that takes into account the opinions of consumers obtained as a result of surveys of end consumers (Katlishin, & Panyshev, 2020).

Conclusions

An expert qualimetric assessment of the quality of drinking milk of the studied brands showed that the best quality is characterized by «Chebarkul milk» (sample № 3), followed by milk «First taste» (sample № 1). Therefore, if you don’t take into account any more criteria of competitiveness, you can recommend to consumers these particular brands of drinking milk. From the point of view of commodity consulting according to the pure criterion of competitiveness quality/ price, the best is sample № 3 «Chebarkul milk», on the second place is sample № 4 «New Day» and only on the third place is milk of sample № 1 «First taste». It is in this ranking sequence that they should be recommended to consumers.

However, the real market situation revealed a different picture of the competitive positions of the studied milk brands, completely different from the ideal picture recommended by experts after assessing the competitiveness using the price-quality method.

The marketing research conducted by the method of direct sociological survey of direct consumers of drinking milk, in addition to other data not included in the material of this article, helped to identify the most significant criteria for the competitiveness of drinking milk in the market segment of 3.2% fat mass fraction and the geographic local segment of Chelyabinsk region. These criteria were the price, information content of labeling, attractiveness of packaging, brand recognition and quality (taste and other organoleptic properties).

The most competitive was sample № 1 «First taste». The owner of the best quality-price ratio is sample № 3 «Chebarkul milk». Sample № 3 «Chebarkul milk», according to real consumer preferences, was only on the third place, leaving the sample № 4 «New Day» ahead.

Thus, the results of the integrated assessment of the competitiveness of the studied milk samples differ from the results of the quality-price ratio. Within the framework of this work, an integrated assessment of competitiveness is a more important and accurate indicator, since, first of all, the opinion of a large number of people surveyed is taken into account, while the quality-price ratio implies an ideal situation with the optimal choice of consumers. In an integrated assessment, the respondents noted the fact of the high cost of milk «First taste», but besides that, bright packaging and a recognizable brand were noted, which played a key role in determining the competitiveness of milk and even the subjective perception of the level of quality by consumers showed the best results with this particular brand. On the basis of these results, it is possible to recommend that trade enterprises of Chelyabinsk region, when forming their assortment matrix, explicitly give preference to this particular brand of milk, which will lead to an increase in sales profit.

The company «Chebarkul milk» can be recommended to strengthen the marketing and advertising component in its activities, to bring to consumers (through tastings, promotions, etc.) an understanding of the high quality of its products and the acceptability of its price. The manufacturer of «Podovinovskoye milk» trademark needs to start its work to increase the competitiveness of milk by improving its quality.