DOI: https://doi.org/10.34069/AI/2021.41.05.18

Strategy for increasing the competitiveness of the Russian company in the global satellite communications market

Стратегия Повышения Конкурентоспособности Российской Компании на Мировом Рынке Спутниковых Коммуникаций

Abstract

The article shows the relevance of work on developing a strategy for increasing the competitiveness of Russian Satellite Communications Company (RSCC) and degree of development of the problem. The logical structure of the research was formed, including such components as the object, subject, initial hypothesis, goal, methodological foundations and practical significance of the research. The mission of the studied RSCC is presented. The essence of the process of strategic planning for increasing competitiveness is investigated and the possibilities of determining the goals and structure of the company are revealed. The reasons for the low economic efficiency of using a standing point in a geostationary orbit for Russian companies are revealed and possible solutions to these problems are identified. There is the system of indicators by which the company loses to its competitors. The market segmentation by frequency resource is presented. The technology of selection of the frequency range by the client is shown. The key factors of the company's success in the global market have been identified and compared using these factors with the main competitors.

Keywords: strategy, competitiveness, satellite communications, key success factors, service life cycle, positioning.

Аннотация

В статье показана актуальность работы по разработке стратегии повышения конкурентоспособности российской компании спутниковой связи, показана степень разработанности проблемы. Далее была сформирована логическая структура исследования, включающая такие составляющие как объект, предмет, исходная гипотеза, цель, методологические основы и практическая значимость проведенного исследования. Представлена миссия изучаемой российской компании спутниковой связи. Исследована суть процесса стратегического планирования повышения конкурентоспособности и выявлены возможности определения целей и структуры компании. Раскрыты причины низкой экономической эффективности использования точки стояния на геостационарной орбите для российских компаний и определены возможные решения данных проблем. Выявлена система показателей, по которым компания проигрывает своим конкурентам. Представлено сегментирование рынка по частотному ресурсу. Показана технология выбора частотного диапазона клиентом. Определены ключевые факторы успеха компании на мировом рынке, и проведено сравнение с использованием этим факторам с основными конкурентами.

Ключевые слова: стратегия, конкурентоспособность, спутниковая связь, ключевые факторы успеха, жизненный цикл услуги, позиционирование.

Introduction

Relevance of the research topic and problem statement. The study is devoted to the development of a strategy to increase competitiveness in the global satellite communications market for a Russian company that owns an orbital constellation in geosynchronous equatorial orbit (GEO).

In accordance with the Decree of the President of the Russian Federation on August 4, 2004 № 1009 and the Order of the Government of the Russian Federation on August 20, 2009 № 1226-p with amendments and additions of RSCC is a strategically important organization in Russia (Decree of the President of the Russian Federation N 1009, 2004).

The company's value for the period from 2011 to 2020 increased almost 2 times. The average annual growth over this period of the company's value in ruble terms amounted to 13.5%, and in dollar terms only to 0.4%. Growth indicators in United States dollar, as more stable currency than the ruble, indicate problems in the company's development. Adjusted for discounting for inflation, the growth in dollar terms is negative. As for the company's revenue for the same period, in ruble terms the average annual revenue growth was 12.4%, and in dollar terms it was almost zero

(-0.03%).

In Russia, telecommunications companies have problems with technological backwardness in the field of microelectronics (3-4 years) and the need to import equipment from Western countries, which reduces their competitiveness in the market. For the satellite communications market, equipment is more expensive, also due to its size. If you do not take decisive action, it will be more difficult to maintain even the current level of achievements in the future.

The main competitors of satellite communications are fixed broadband access to the Internet and fixed voice communications (using wire and fiber-optic communication lines, twisted pair, etc.), mobile communications and terrestrial television (terrestrial wireless communication lines).

Taking into account the fact that the telecommunications industry is developing rapidly in terms of technical progress, it is difficult to predict what will happen in 10-15 years, and therefore, the company cannot exist without strategic planning.

Degree of elaboration of the problem. The main problems of developing and increasing the competitiveness of satellite communications were considered by many people. Their list can include almost all top managers of satellite operators who have published a lot of articles on this topic. In Russia, in most cases, top managers are people with technical education and extensive management experience.

General Director of RSCC, Yu. V. Prokhorov (Honored Tester of Space Technology, Academician of the International Academy of Communications), has written many scientific papers on the strategic development of satellite communications, thus the company understands the need for strategic development.

Most of the heads of satellite operators, including V.N. Doniants and S.V. Pekhterev, believe that the high price of a satellite frequency resource greatly inhibits the development of satellite communications.

In one of his article, Academician of the International Telecommunications Academy E.V. Buidinov tried to assess the socio-economic efficiency of satellite communications (Euroconsult-ec, 2019). From the obtained results, he concluded that the socio-economic efficiency of satellite communications for the Russian Federation can be increased by more than 1.5 times.

The increase in the competitiveness of satellite communications is also facilitated by the development of terrestrial infrastructure for it, in connection with which this issue is raised among the developers of technical means for satellite communications. Such leaders in the production of satellite equipment, including hubs, such as Gilat, Hughes, Comtech, iDirect, Newtec and others, are betting on the B2B sector and mobile networks of the fourth and fifth generation, as they spoke about in their presentations at the latest Satellite Russia & CIS in the spring of 2018 and 2019 and the scientific works of the employees of these companies were published. They understand that satellite communication is very expensive for the end user and the use of expensive equipment greatly reduces the cost for the end user. As for mobility, it is higher for the end user, because a parabolic antenna with a diameter of 0.45-1.2 meters cannot be taken with you.

The object of the research is the competitiveness of Russian operator in the global satellite communications market.

The subject of the research is the process of strategic planning to improve the competitiveness of Russian operator in the global satellite communications market.

Scientific research hypothesis. The implementation of a strategy developed on the basis of an analysis of the telecommunications market in order to identify the demand for certain satellite communication services will allow RSCC to increase its net sales income and improve its efficiency, which will strengthen its competitiveness in the world market (Burdina et al., 2020; Burdina & Bondarenko, 2020).

Purpose of the study is: on the basis of theoretical studies of the telecommunications market and the identified new directions in the company's activities in the field of satellite communications, to make a new strategy for its development, taking into account internal and external factors.

The mission of RSCC is to create under the study an extensive information space based on the Russian satellite constellation using advanced technologies.

We note that the overall corporate strategy and the strategy for increasing competitiveness coincide in many respects. In this regard, it is sometimes difficult to draw the line between strategic planning and the development of a strategy to improve competitiveness. Strategic development opportunities are ways to improve competitiveness. Market attractiveness is essentially the market potential, which largely depends on the internal environment of the company.

Theoretical Basis

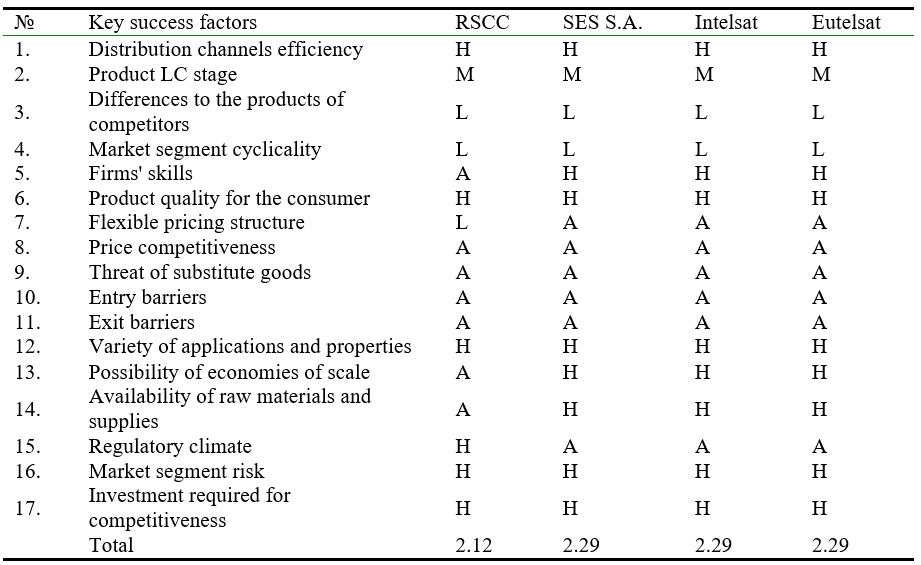

During the research, the theory of strategic analysis was used (Novikov, 2018), including the research of competitors and portfolio analysis. The problems of increasing the company's competitiveness in the global satellite communications market have been identified, for the solution of which the market will be segmented by frequency resource. The factors of competition and key factors of the company's success are identified, and a comparison is made using these factors with the main competitors. In this case, the following abbreviations for the assessment rating were used: H - High (3 points); A - Average (2 points); L - Low (1 point), and by the phase of the service LC: G - Growth (3 points); M - Maturity (2 points); R - Recession (1 point). To clarify the strategy, further detailed strategic portfolio analysis was carried out using McKinsey and ADL matrices. To construct them, an expert predictive analysis of the competitive position of the analyzed enterprise was carried out, as well as forecasts of its development: optimistic and most probable. To identify the directions of the company's strategic development, assessments of the market attractiveness of the company's main product or service were carried out. Further, the theory of strategy formation was used, for which the main problems of enterprise development and the reasons for their occurrence were identified. According to the well-known theory of strategic management and hierarchy, strategies are divided into general and business ones, the latter including competitive and portfolio strategies. The proposed theory of the formation of strategic measures includes three components:

- Comparison of sectoral problems with the problems of the enterprise, including allocation of problems to be solved and the definition of a group of strategic measures for their solution;

- Formation of strategic actions that translate organizational problems into development opportunities;

- Creation of strategic activities that are most consistent with the potential capabilities of the enterprise.

The study proposes a theory of the formation of a positioning strategy based on selected opportunities and steps aimed at their implementation (Komarova et al., 2019; Novikov et al., 2019a).

In accordance with the theory from earlier works (Novikov et al., 2019b; Novikov et al., 2020), staff management strategy was developed, within which it is possible to use network working groups.

Methodology of Research

The conducted research is of a problem-systemic nature. The challenge is to improve the competitiveness of the company. The conducted research and comparison of Russian and foreign competitors in terms of competition factors showed that the economic efficiency of using a standing point on the GEO for a Russian company is extremely low, compared to the giants. There are several explanations for this:

- prices for services are higher in foreign companies;

- higher workload or heavier spacecrafts of foreign companies;

- high degree of integration with additional services of foreign companies;

- large discount for government agencies.

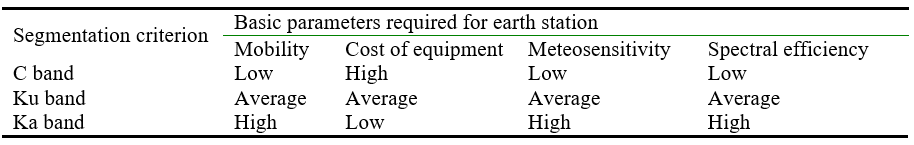

One of the possible solutions to these problems is segmenting the market by frequency ranges, namely by important parameters for customers when operating in these ranges (Table 1): mobility, equipment cost, meteosensitivity and spectral efficiency.

Protective measures of the Russian government (Dmitriev & Novikov, 2019a; Dmitriev & Novikov, 2019b; Dmitriev & Novikov, 2020) helped to increase the amount of consumed frequency resource. These measures forced all state-owned companies (including Central Bank of Russia) to forcibly switch to Russian spacecraft. But this, at the same time, had a negative impact on the expansion of foreign markets by Russian telecom operators, as some states made the same thing.

The choice of the range by the client depends on various components. For example, C band is chosen for fixed terminals, where the size of the terminal and the compactness of the transmitter are not important. For example, there are two types of transmitters: SSPA and TWTA. SSPA is very compact, but also with very small power (0.5-8W), while TWTA is huge and weighs from 25 Kg, but at the same time the power is much higher (from 200 W).

Table 1.

Market segmentation by frequency resource (source: authors)

Ka band is important for those who want to obtain compactness and high spectral efficiency, but the price for this is the instability of the same spectral efficiency. Thus, this range is ideal for satellite internet.

Ku band is chosen by those who need an intermediate version. For example, direct TV broadcasting is convenient in Ku. Since the normal stability of the spectral efficiency is needed due to the fact that technologies that allow to level this cannot be applied in simplexes (one-way communication channel), and keeping the power headroom is sometimes not profitable due to the high cost of transmitters. The approximate price of a 750 W transmitter is about 2 million rubles. In this case, firstly, we also need backup transmitter. And secondly, real maximum allowable power, depending on the code-signaling structure, drops significantly. Therefore, at best out of 750W, 350W can be used. In "linear mode" we can only use 50W.

For example, if the C band for earth station on the territory of Russia for reception with an availability factor of 99.7%, an energy margin of 1 dB (+ 25%) is recommended, for Ka it is already 5 dB (+ 216%). For Ku, this is 3 dB (+ 100%), i.e. double margin and at the same time the size of the antennas is small (0.6-1.2 m), which is very convenient. This is without considering the up line. In general, this applies to the whole world, with the exception of regions with intense precipitation.

As a part of the competitive analysis of the object of research on the global satellite communications market, it is assumed that the key success factors (KSF) of the company are selected. Table 2 presents the selected KSF and shows the comparison results according to these factors of RSCC and the main competitors.

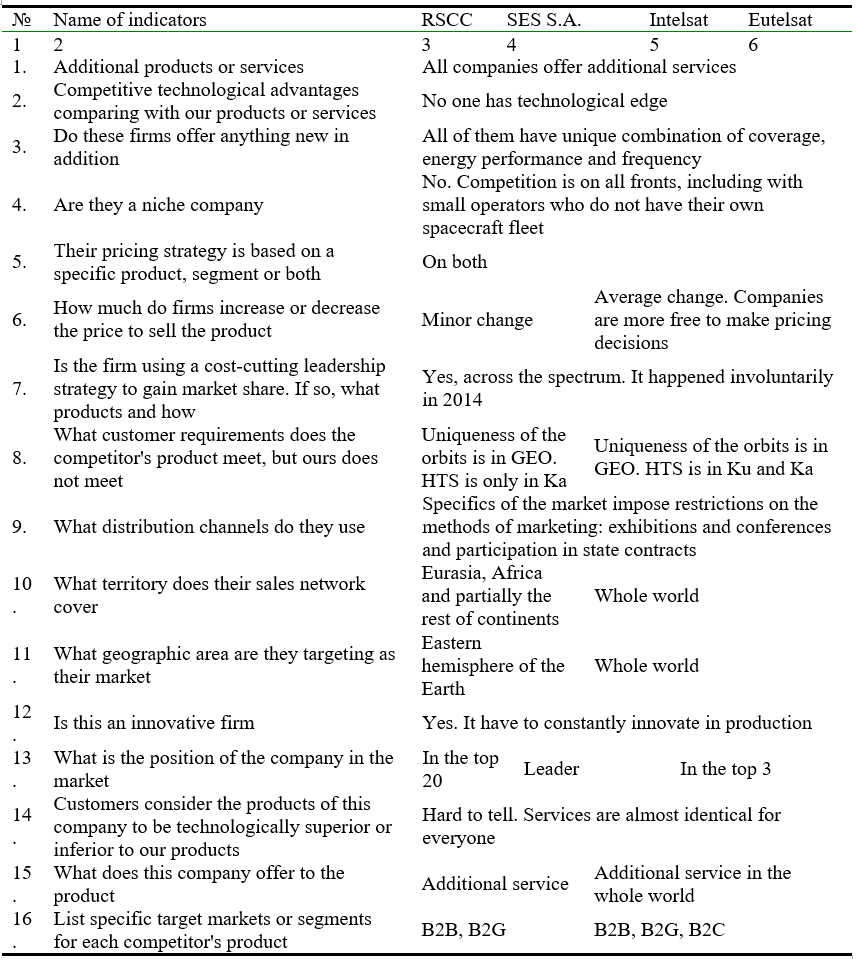

As we can see from the data presented in the Table 2, the main KSF of RSCC is the regulatory climate, for the rest of the KSF the company either matches its competitors or has a worse result. Thus, the company is encouraged to use a flexible pricing policy more widely, because, as Table 3 shows, the company changes prices slightly to sell the product.

Table 2.

Assessment of competition by key success factors (source: authors)

Table 3.

Comparative evaluation with competitors (source: authors)

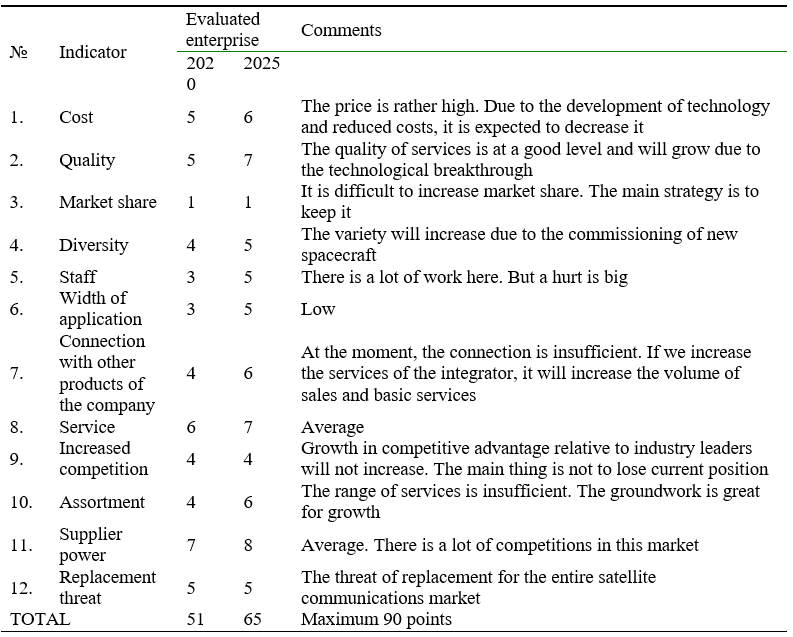

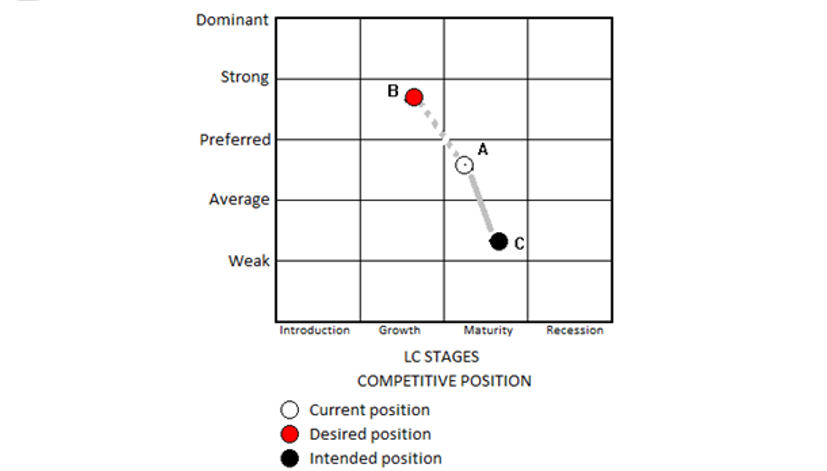

The constructed matrix ADL/LC is shown in the Figure 1. To build it, an expert predictive analysis of the competitive position of the analyzed enterprise was carried out, as well as forecasts of its development: optimistic and most probable. The results of this analysis are presented in the Table 4.

As the analysis showed, the company's product is in the maturity stage. If new measures are not introduced, the position in the market can be greatly shaken. To prevent this, it is necessary to use an innovative development strategy, the development and implementation of innovative design and technological solutions, the creation of a scientific and technical groundwork.

Table 4.

Evaluation of the current and predictive assessment of the competitive

position of enterprise product (source: authors)

Figure 1. ADL/LC matrix (source: authors)

The company occupies a large market volume in Russian market (more than ~ 1/3), but as for the volume of the world market, it is very small, only 1.75%. On the other hand, RSCC has an advantage artificially created by the state, which makes it possible to increase its share in Russian market, while large losses of its share in the world market are not expected.

Analysis of the market attractiveness is above average and will grow in the future. The main threats are: negative growth of the satellite communications market, emergence of new competitors and regulatory climate and other risks.

Calculation of the competitive status of the enterprise shows that it is currently quite high and has prospects for further growth. Projection of the competitive position and high attractiveness of the market to the McKinsey matrix shows that it is necessary for an enterprise to choose a portfolio growth strategy associated with active actions to improve its competitive status, to attack the position of the best; to strengthen the weak points of your inner potential; to invest based on their own capabilities. Thus, selective investment in growth is required to further develop the company's products.

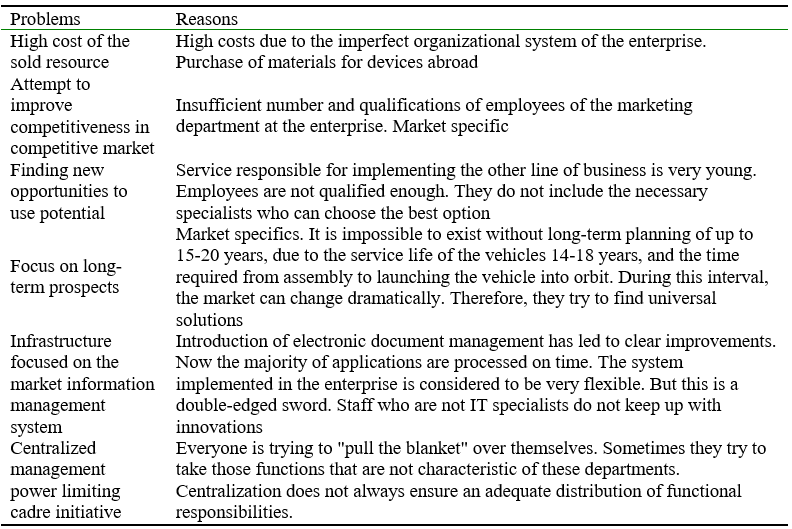

Thus, we have formed a competitive and portfolio development strategy, then, to form a system of strategic measures, we will consider the main problems of enterprise development and the reasons for their occurrence (Table 5).

Table 5.

Main problems of the enterprise and their reasons (source: authors)

The company's products are attractive and generally in demand. There is a reserve for growth. Good management resources and marketing are needed. If in terms of management the classical methods are suitable, we need to be very careful with marketing, because it is very easy to lose confidence in this market (Mikhailova, 2020).

More flexible pricing policy is also needed, since the resource for different clients and regions has different values (Tikhonov et al., 2020). It is necessary to improve customer support at the very beginning. This will help clients to better familiarize themselves with the resource and understand its main consumer qualities. For example, an improperly selected apparatus and barrel can greatly increase the cost of an ongoing project. Strict cost control, frequent detailed monitoring reports, clear structure in the organization and distribution of responsibilities are required. The main incentive is the strict implementation of the production volume plan.

It is especially worth highlighting the problem of low qualifications of employees of some clients. Due to a misunderstanding of some points, incidents occur that negatively affect further cooperation. Thus, the solution to this problem is associated with the organization of the advanced training system.

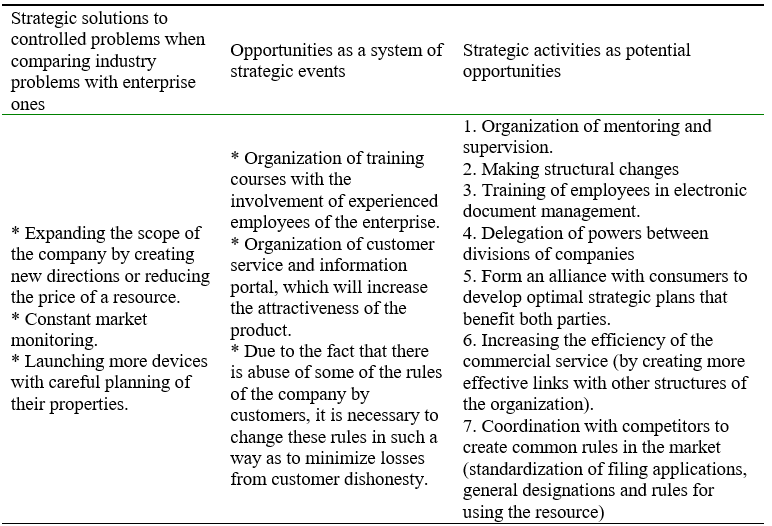

The portfolio strategy presupposes the development of the internal potential of the enterprise and its competitive status, therefore, for the implementation of this strategy, Table 6 gives a group of strategic measures selected according to the theory developed by the authors.

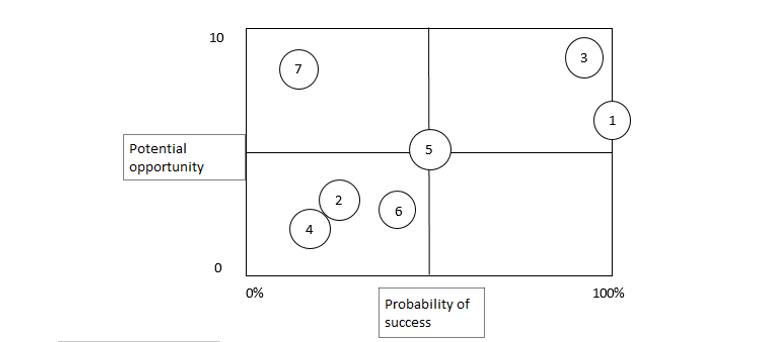

Based on the results of the assessments carried out in the work, a matrix of opportunities was built (Figure 2). It shows that items 2, 4 and 6 are the least realistic, but they can be very effective. The attractiveness for the enterprise from the implementation of these measures is also small, since they are very painful. Opportunity matrix indicates the need to develop a positioning concept in terms of consumer appeal and success probability.

These strategic measures allow increasing the capabilities of project teams of development companies (Dmitriev & Novikov, 2019a; Dmitriev & Novikov, 2019b) when working on projects that require new and non-standard solutions in the face of growing competition and resource shortages. The conditions for the expediency of using network design teams based on the results of studies of their capabilities.

Table 6.

System of strategic decisions (source: authors)

Figure 2. Matrix of opportunity (source: authors)

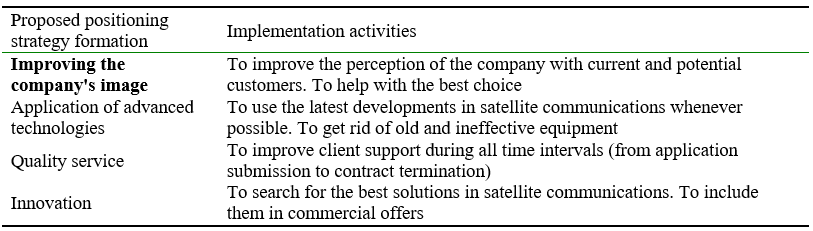

Table 7.

Positioning strategy formation (source: authors)

Results

In the process of developing a strategy for increasing the competitiveness of the company, RSCC conducted research and developed management decisions. The following results were obtained:

- conducted research and comparison of Russian and foreign competitors in terms of competition factors, the economic efficiency of using a standing point in the GEO for Russian company is extremely low, in comparison with giants. There are several explanations for this: prices for services are higher for foreign companies; higher workload or heavier spacecraft from foreign companies; high degree of integration with additional services from foreign companies; large discount for government agencies.

- research proposes a solution to this problem by developing a set of business strategies, including the following components: portfolio, competitive and positioning strategy and system of strategic events.

- strategic competitive analysis showed that the current company loses to its competitors on some indicators. The fact that it remains afloat is a great merit of the state, in terms of politics and scale of the territories and unevenness of their settlement. Therefore, the company needs to segment the market by frequency ranges, namely by important parameters for customers when operating in these ranges: mobility, equipment cost, meteosensitivity and spectral efficiency.

- based on the results of comparison of the considered company with competitors, according to the factors of competition and success, the competitive strategy of the company was proposed as the optimal ratio of the strategy "price-quality".

- in the course of the expert forecast analysis, scenarios of its development were built: optimistic and most probable. It was determined that the company's product is at a stage of maturity, therefore it was recommended to use an innovative strategy for its development, the development and implementation of innovative design and technological solutions and the creation of a scientific and technical reserve.

- to identify the directions of the company's strategic development, assessments of the market attractiveness of the company's main product or service were carried out. As the analysis has shown, the attractiveness of the market is above average and will grow in the future.

Discussion

Strategic competitive analysis showed that the current company loses to its competitors in some indicators. The fact that it remains afloat is a great merit of the state in terms of politics and scale of the territories and the unevenness of their settlement. Thus, artificial favorable environment was formed for the current company. As for the large share in the foreign market (53% of revenue for 2019), this is the merit of geopolitics. Due to the fact that the source of income is not important for capitalism, foreign companies "huddle" different warring parties in international conflicts. Accordingly, if it is the enemy of the United States and the coalition, leasing from Western companies is impossible.

The strategy proposed in the work allows taking into account external opportunities and translating development threats and weaknesses of internal potential into development prospects.

The practical significance of the study is determined and confirmed by the fact that the conclusions of this study can be a guide for all enterprises in the satellite communications market, both defense and civilian, facing the problem of competitiveness in the telecommunications market.

Further research will be related to assessing business risks for the space communications operator and ways to eliminate them researching the demand for satellite communications services in the telecommunications market and developing a comprehensive program and assessing the effectiveness of the implementation of a strategy to increase competitiveness in the global satellite communications market of Russian company.Conclusions

Predictive analysis of the effectiveness of the proposed set of strategies showed that increasing the volume of satellite resource by 2 times and bringing the share of additional services to 87% will increase the average annual growth of net sales income by 4.98% per year with revenue of 4.53% per year, which is more than the current inflation of 3.05%. Thus, the effectiveness of the implementation of the strategy to increase competitiveness and the research hypothesis are proved.