The Unrevealing Nexus between Foreign Direct Investments, Institutional Quality and Financial Development in Pakistan

El nexo no revelador entre inversiones extranjeras directas, calidad institucional y desarrollo financiero en Pakistán

Abstract

The study examines the nexus between FDI, institutional quality, and financial development in Pakistan. We believe that it is a novel research attempt as it covers both democratic and non-democratic regimes. We use linear ARDL methodology to predict the nature of the relationship as a baseline estimator and Granger causality as a robustness check for further validation of results. The study covers the period from 1990 to 2018. We find that both FDI and institutional quality positively affect financial development in Pakistan. We find bi-directional causality between financial development and institutional quality and a unidirectional casualty between FDI and institutional quality. Likewise, we also find a unidirectional causality between FDI and financial development, running from financial development to FDI. The study has some managerial implications for policymakers to strengthen the country’ macroeconomic environment and to encourage institutional reforms to boost up the confidence of local as well as foreign investors.

Keywords

Foreign Direct Investments, Institutional Quality, Financial Development, ARDL, Pakistan.

Resumen

El estudio examina el nexo entre la IED, la calidad institucional y el desarrollo financiero en Pakistán. Creemos que es un intento de investigación novedoso, ya que cubre tanto regímenes democráticos como no democráticos. Usamos la metodología ARDL lineal para predecir la naturaleza de la relación como estimador de línea de base y la causalidad de Granger como verificación de robustez para una mayor validación de los resultados. El estudio cubre el período de 1990 a 2018. Encontramos que tanto la IED como la calidad institucional afectan positivamente el desarrollo financiero en Pakistán. Encontramos una causalidad bidireccional entre el desarrollo financiero y la calidad institucional y una víctima unidireccional entre la IED y la calidad institucional. Asimismo, también encontramos una causalidad unidireccional entre la IED y el desarrollo financiero, que va desde el desarrollo financiero hasta la IED. El estudio tiene algunas implicaciones de gestión para que los responsables de la formulación de políticas fortalezcan el entorno macroeconómico del país y fomenten las reformas institucionales para aumentar la confianza de los inversores locales y extranjeros.

Palabras clave

Inversiones extranjeras directas, calidad institucional, desarrollo financiero, ARDL, Pakistán.

Introduction/Background of the study

Financing decisions have a major role in the modern economy, and FDI inflow is measured as a powerful engine for the prosperity of the economy. It is the main factor of globalization, which enable emerging economies with a poor economic system to enhance their physical capital, skill transfer, job creation, productivity, skills and capacity of the workers, and boost the host economy (Quazi, 2007; Smith, 1997). FDI helps in generating collective funds in local investment, transfer of technical and managerial skills, encourage competition, provide job opportunities, and increase in access to the global market for goods exports. FDI helps long-term monetary gain, interest for foreign investors, and plays a key role in host country dynamic economic development (Levine, 2005; Pagano, 1993). Financial liberalization caused by FDI and technical inventions makes businesses easier throughout the world. However, countries get an inflow of FDI intending to make attractive profits and make a market free economic model that encourages the foreign direct investment flow in the globalization era. Research shows an important FDI effect on the third world countries' economic growth by establishing a bridge between the gap of investment and domestic savings. However, Hanson, Mataloni Jr, and Slaughter (2001), also argue the lack of evidence of positive spillovers generated by FDI in the host country. While in contrast, Görg and Greenaway (2004) document that FDI adversely affects the financial development of a country. For emerging economies, FDI has a very important role in the capital inflow to the host country and it is considered as an important agent for practical and manufacturing development. Recently some of the studies found that inward FDI affects the institutional quality of the host country. Some of the studies confirm that inward FDI has the potential and role in lowering the corruption level in this regard. Larraín B and Tavares (2004) empirically confirm the corruption level in many countries, which is minimized by FDI. While in contrast, Pinto and Zhu (2016) state that FDI positively affects corruption in poor countries where the democratic system is fragile and states that the effect becomes negative when the country starts strengthening its democratic system. Similarly, Islam and Montenegro (2002) assert that a more open economic system results in better intuitions and promote economic growth. Because most of the foreign, as well as domestic firms, start lobby. With the government for structural change and open economy prevail higher competition that could reduce the rents for bribery and would make corruption more difficult (Ades & Di Tella, 1999). In a similar study, foreign investors have been found impacting the policy environment in Eastern European nations and for the Soviet Union (Kweka, Morrissey, & Blake, 2003; Lewis, 2005). FDI is very helpful for those countries which are in transitional phase and pursue various economic reforms (Malesky, 2009). Intuitional qualities are key determinants of the country’s economic prosperity and economic growth. It has an impact on the governance system, financial development, and overall economic growth. Countries with better institutional qualities smoothly function, perform, and contribute to the financial development which resultantly promotes overall economic growth (Butkiewicz & Yanikkaya, 2006). The institutional quality variable i.e. corruption affects the volume of investment by foreign investors in the host country (Knack & Keefer, 1995). Moreover, the rule of law, civil liberty, political rights, and corruption index significantly affect the investors’ behavior and determinants of economic development (Sala-i-Martin, 1997). Intuitional heterogeneity exists in various regions, and it has a direct effect on the economic performance of various countries in a region and across regions (Mauro, 1997). Countries with weaker intuitions perform poorly as compare to those countries which possess a sound mechanism of institutional quality, where institutional quality is based on good and efficient governance (Busse & Hefeker, 2007). Hence, institutional quality represents good governance which predicts an uplift in financial development (Fischer, 2010). Similarly, Cristina Jude and Levieuge (2015) assert that institutional quality can indices more investment due to the structural rule of law and governance system, which directly affect the countries financial development and overall economic growth. The study is a unique study due to many reasons. First, in the context of Pakistan no such a study has explored the relationship of these variables. Secondly, the study covers period which is comprised of both democratic and non-democratic regimes. Third, the study contributes to the body of literature in a way as previously no such a study has yet accounted for both democratic and non-democratic eras.

Literature Review

There are many studies available that highlight the association between foreign direct investment and F.D. However, there is a scarcity of the consent on the beneficial connection between economic growth and financial development. The increasing concern for researchers today is why levels of financial development change across the regions (Law & Singh, 2014). Economic development is a vital issue in FD. With the constant growth in financial development, the growth of financial measures, the demand for real monetary tools and facilities from households and businesses are also growing simultaneously (Goldsmith, 1969; Gurley & Shaw, 1967). This uplifting stimulates novelty and growth in the economic segment and resultantly, the fiscal segment increases the financial growth as well (Robinson, 1952). The culture and legal system of a country affect the level to which investors and property rights are protected and it influences the modality of the country’s financial markets (Lewis-Beck & Tien, 2008). However, La Porta, Lopez‐de‐Silanes, Shleifer, and Vishny (2002) in their study postulate that legal systems of the countries are classified by their cultural origins and further elaborate that the differences exist in legal origins among the sample countries. For example, the German legal system is more bank oriented. Dutta and Mukherjee (2012), also demonstrate that in regions where the public inclined to be more energetic in economic events, leads to an advanced level of economic growth in the regions. While, Rajan and Zingales (2003) argue that open market access increases capital flow, which promotes financial development and the same has two aspects of trade opening and capital account opening. Further supported by Do and Levchenko (2004) confirming that trade openness touches outside funding demand which results in up-surging financial development.

Foreign direct investments and financial development

In the receiving region, the role of foreign direct investment inflow and its contribution to financial development has been explained broadly. However numerous studies show a substantial influence of foreign direct investment on the host country. There are divergences in the outcomes about the influence of foreign direct investment on financial development. Like, some notable researchers postulated a positive effect of FDI on financial development (Blomstrom, Lipsey, & Zejan, 1992; Havranek & Irsova, 2011; Javorcik, Saggi, & Spatareanu, 2004; Reganati & Sica, 2007). Similarly, some researchers failed to find any positive relationship between FDI and financial development (Borensztein, De Gregorio, & Lee, 1998). However, Azman-Saini, Baharumshah, and Law (2010) found a threshold model for financial market advancement to determine its role in the effect of FDI on financial growth in the host country. The abundance of natural resources in a country can affect the volume and the nature of FDI, the country attracts, and it also affects the financial development of the country. The abundance of natural resources can enhance investment in quicker growth opportunities in the region. Similarly, Corden (2012) highlights the importance of FDI and postulates that it further improves the slow-growing factors. Similarly, Aleksynska and Havrylchyk (2013) proclaim that countries with weaker institutional quality can attract a huge amount of FDI at the cost of the abundance of natural resources. Likewise, Chadee and Schlichting (1997) assert that some characteristics of FDI in the Asia-Pacific countries attract foreign direct investment and contribute to the financial development which helps in overall economic growth. Ram and Zhang (2002) asserted that FDI offers a complete entry to the world markets and acts as an intermediary for the host country to contribute to the globalization process and modernization of the financial system. Hence, there are many studies, that highlight the role of FDI in financial development (Havranek & Irsova, 2011; Javorcik et al., 2004; Reganati, Pittiglio, & Sica, 2008).

The flow of foreign direct investment has been observed as the main vehicle for growth for emerging economies (Unctad, 2006). Foreign direct investment may affect economic performance through moving services, technology, and organization of knowledge that rise efficiency and allow national businesses to contest in world markets (Javorcik et al., 2004; Lipsey, 2003). It is also offering capital and service occasions which is not obtainable nearby. Furthermore, foreign direct investment assists the institutional quality of host countries. For instance, some current literature found that FDI inflow can affect corruption stages (Dang, 2013; McCloud & Kumbhakar, 2012). Larraín B and Tavares (2004) also found that foreign direct investment significantly reduces corruption level. There are numerous positions through which foreign stockholders could considerably affect local economic action and governance (Luo, 2002; Prakash & Potoski, 2007). Due to the positive nexus between foreign investment and business environment, it is expected that the national private sector could also get benefit from local governance improvement and enhanced public facilities. For instance, transparency and improved appeals events will lead to a drop in informal protections. Transparency requirements should be predictable to meaningfully expand access by the remote segment to legal normative forms at the national and provincial levels (Malesky, 2007). Similarly, Zhang (2001) and Choe (2003) examine the nexus between foreign direct investment and financial development, using the data of emerging economies in Latin America and East Asia and found significant nexus. Likewise, Frimpong Magnus and Oteng-Abayie (2006) declared the contributing relationship between foreign direct investment and economic development for Ghana for the pre- and post-structural adjustment program Kulshrestha et al. (2017) eras and found the footprint of the connection between these two variables. Bengoa and Sanchez-Robles (2003) explained the association between foreign direct investment, financial freedom, and financial development using panel data for Latin America, applying fixed-effects and random-effects estimates and reported that foreign direct investment has a significant positive effect on host country financial development and economic development. Carkovic and Levine (2002) used a panel data set covering 72 advanced and emerging economies to analyze the relationship between FDI inflow and financial development and confirmed the contribution of FDI in reducing corruption, law and order, and governance. Borensztein et al. (1998) scrutinize the role of foreign direct investment in the procedure of technology dispersion and economic development. The study postulate that foreign direct investment has a positive impact on financial development, but that the scale of the effect depends on the quantity of human capital obtainable in the host country. In contrast to the previous literature, De Mello (1999) found footprints of a positive nexus between foreign direct investment and financial development even with using both time series and panel fixed effects estimates for a sample of 32 advanced and emerging economies. Likewise, Olofsdotter (1998) Using cross-sectional data and found that growth in the stock of foreign direct investment is positively linked to development and that the outcome is stronger for host regions with an advanced level of institutional ability as measured by the degree of property rights, safety and governmental efficiency in the host country. FDI is the key source of capital inflow, there is a positive influence of foreign direct investment on host region financial development and economic growth (Alfaro, 2004; Borensztein et al., 1998). Desbordes and Wei (2017) consider that financial growth in host regions as well as the region of the sources are positively connected to foreign direct investment. Maximum works on the topic highlight that a host country needs an adequately sound economic market for foreign direct investment to enhance financial development widely (Alfaro, Chanda, Kalemli-Ozcan, & Sayek, 2010).

H1: FDI is Positively Related with Financial Sector Development

Foreign Direct Investment and Institutional Quality

In modern literature, it has been observed that good governance regions can attract and encourage FDI, while weak governance fails to protect investments (Ali, Fiess, & MacDonald, 2010; Gani, 2007; Globerman, Shapiro, & Tang, 2004). According to Shang-Jin Wei (2000), institutional variables like, political instability, corruption, and property rights issues are the determinants of the FDI inflow. One of the studies conducted on 17 Latin American countries panel by Staats and Biglaiser (2012), indicate the rule of law and consider strength in judicial systems is a key factor of FDI. Henisz (2000) argued that countries with poor property rights are less attractive to multinational investments. Similarly, Jiménez and Delgado-García (2012) argued that investors implement internationalization policies, and preferably, politically stable countries help to minimize risk while getting benefits by acquiring managerial access and diversify their FDI portfolio. Dunning (2002) further indicates that economic freedom and good governance are key determinants of foreign direct investments. Multinational companies’ preferences are shifting from traditional natural resources and labor availability to greater efficiency-seeking in good governance, and economic freedom (Addison & Heshmati, 2003; Becchetti & Hasan, 2004; Loree & Guisinger, 1995). Supporting the same school of thoughts, Johnson and Dahlström (2004) stated that instability of law and order result in corruption, and majority of researchers consider corruption as one of the vital institutional issues which affect the inflow of FDI. In sum-up host regions with positive corruption index scores have lower investment inflow (Asiedu & Villamil, 2000; Campos, Lien, & Pradhan, 1999; Cuervo-Cazurra, 2008; Gastanaga, Nugent, & Pashamova, 1998; Shang-Jin Wei, 2000). On the other hand, financial development is determinant of the institutional quality (North, 1990). Previous research confirmed that in the case of FDI in the context of developing economies considers institutional quality as an important factor for economic growth stimulation. Likewise, Steven Globerman and Shapiro (2002) observed a strong return for good governance in developing countries as compared to the rest of the sample countries. According to C Jude and Levieuge (2013), it is a very common view among the researchers and other academicians that the developing poor countries face economic hurdles mainly due to lack of good governance. This results in lower investments, unemployment, a decrease in per capita income, and overall foster to slower down the output growth. Similarly, North (1990) postulates that good institutions raise productivity and financial movement by reducing production and transaction costs, and vice versa (Cuervo-Cazurra, 2008).

H2: The effect of FDI on economic growth is more pronounced in countries with higher institutional quality

Institutional Quality and Financial Development

Many studies have evaluated the nexus between institutional quality and financial development, specifically literature on the effects of the lawful and controlling situation on the operation of financial markets. Legal and monitoring schemes and complete accounting practices have been recognized as very vital for financial growth. Explaining the essence, (Buchanan, Le, & Rishi, 2012; Levchenko, 2007) documented that the roots of the legal code significantly influence the action of stockholders and creditors and the effectiveness of the agreement. And political economy helps to financially develop a country (Law & Singh, 2014; Levine, 2005; Pagano, 1993; Roe & Siegel, 2011). Likewise, Roe and Siegel (2011) and Haber, North, and Weingast (2008) also explained the role of government in economic growth in the context of Mexico and the United States and concluded that institutional quality legal framework and strictness for corruption control will help in financially developing the countries. Societal capital is often well-defined as collective guidelines that encourage collaboration among individuals and help in promoting the financial development and farther elaborated that promoting trust culture and eliminating fraud in the corporate sector encourage financial development (Coleman, 1988; Ostrom, Schroeder, & Wynne, 1993). C. A. Calderón and Chong (2006) investigated that social capital and economic growth enhance the effectiveness of commercial banks, stock market, and bond market development. Likewise, Aitken and Harrison (1999) explained that foreign direct investment encourages exports of host regions by increasing local capital for exports, assisting the removal of expertise and additional goods for exports, and easing access to new and large foreign markets. Many studies show that institutional quality is a major effect on cross-country differences in both per capita income and economic growth (Azman-Saini et al., 2010; Compton & Giedeman, 2011; De Haan, Lundström, & Sturm, 2006; Khan & Senhadji, 2003). Similarly, L. M. R. Alfaro (2004) and Barro (2000) asserted that safe property rights enhance development act not only by promoting investments, but also tends to improve the efficiency of investments.

H3: Institutional quality has a significant effect on financial development in the host country

Methodology

Research Design/ Data and variables

The study aims to examine the relationship between FDI, intuitional quality, and financial development. We collect the data from (WDI) World development indicator for the findings of the relationship of variables in the study. We use the Pakistani data covering the span from 1990-2018. We collect the data of FDI, Intuitional quality, and financial development to conduct empirical analysis for hypothesis testing. We denote FDI, for Foreign Direct Investment, INSQ, for institutional Quality and FD for financial development. FDI is measured as (annual %). The same measurement method has been used by previous scholars (Busse & Groizard, 2006; Liu, 2011). Financial development is measured as (% of GDP), in the spirit of previous studies (Aggarwal, Demirguc-Kunt, & Martinez Peria, 2006; King & Levine, 1993; Perez-Moreno, 2011). While, Intuitional Quality is measured as the composite of six elements i.e. (Voice and accountability, Government effectiveness, Political stability and absence of violence, Regulatory quality, Rule of law and control of corruption) (Aibai, Huang, Luo, & Peng, 2019; Kaufmann, Kraay, & Mastruzzi, 2011).

Model

FD = f (FDI, INSQ) Ut

Whereas,

FD = Financial development

FDI = Foreign Direct Investment

INSQ = instructional Quality

Estimation Technique and Data Collection

Being in mind the small number of time series data, this study proceeds with using time series for Pakistani data for the period 1991-2018. The following general specification of time series data has been modified:

FD= f (FDI, INSQ)

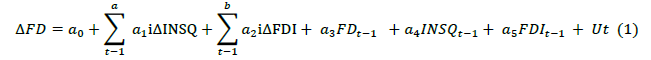

FD is Financial Development, INSQ is institutional quality, and FDI is the foreign direct investment, while Ut is the error term. Our model uses Financial Development (FD) as a dependent variable, while institutional quality (INSQ) and FDI as independent variables. FDI has a positive impact on financial development in the model. This study adopts Autoregressive Distributed Lagged (ARDL) technique with a co-integration approach (Pesaran & Shin, 1998; Pesaran, Shin, & Smith, 2001). ARDL has been widely used in the modern experiential research due to some required structures, unlike Co-integration methods have some serious faults: efficient for large samples frequently, the order of integration of variable, large sample and pre-test are some preconditions (Engle & Granger, 1987; Johansen, 1995; Johansen & Juselius, 1990). While ARDL provides friendly assessments both in the long run and short run, even with small or finite sample sizes. The ARDL model is structured as

α1, and α2, represent the coefficients, which explain the short-run estimations, while α3, and α4 and α5, are the coefficients assessed of the long estimations; a, b, c, d, e, f, and g are the positive number and the upper limits of summations. In the third step procedures, long-run coefficients (α3 … α5) do not use for interpretation with the dependent variable, but it is used to get values of restricted F-statistics. Like, previous researchers, we also follow a three-step approach for ARDL analysis. At the initial first stage, the equation (01), is estimated and later the long-run coefficients are redistricted for obtaining restricted F-statistics. While in the second step, the restricted F- statistics value is analyzed and tested to check the co-integration in variables. We construct the null hypothesis for the restricted paradigm as

H0: α1= α2, = 0 (there is no long-run relationship amongst the variables)

H1: α3= α4 = α5 ≠ 0 (there is long-run relationship amongst the variables)

The following restraint is compulsory on the selected limits of equation 1. The null hypothesis testing procedure is conducted based on F-statistic or Wald test, if the null hypothesis is rejected, we may further proceed to the long run estimation.

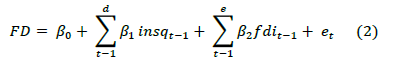

Where d and e show the upper limits of the summary. Equation (2) gives a quantity of the long-run elasticity but might be the short-run deviations from the long-run steadiness, then we go for the Error Correction Model (ECM) to estimate these dynamics. It can be calculated as follows.

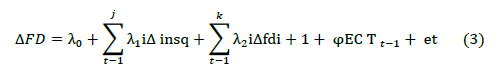

The j and k show the upper limits of summations. The ECTt-1 is the error correction term and the coefficient of ECTt-1 measures the speed of adjustment of the model. The negative sign of φ will suggest the merging property of the model whereas a positive φ displays the divergence from the symmetry. The data period for financial development and foreign direct investment (FDI) is taken from the World development indicator database (1990-2018).

Empirical Analysis and Results

Stylized Fact

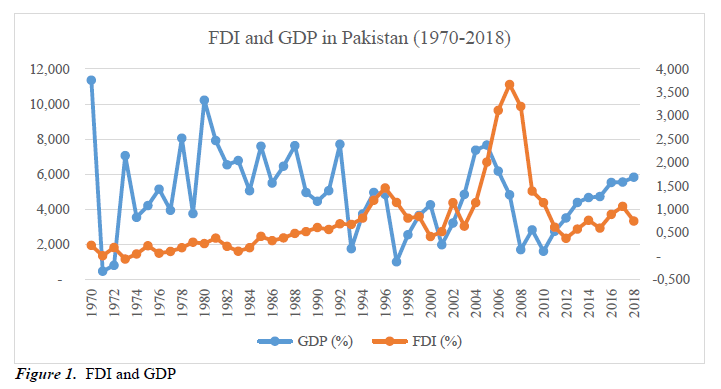

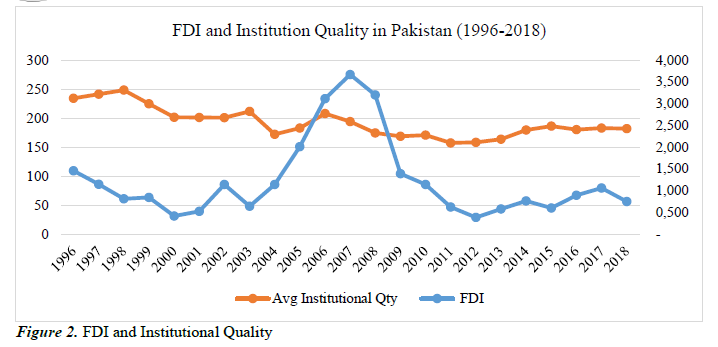

FDI and GDP

Figure 1 depicts the FDI and GDP of Pakistan from 1970 to 2018. The graph shows very clearly the impact of regime change on the FDI of state and its corresponding impact on the GDP of Pakistan. From 1970 to 1999 the FDI curve moves on average, but from 2000 to 2008 the FDI curve is very peaked and shows a drastic increase in FDI inflow to Pakistan. It was the time of dictatorship when General Pervez Musharraf declared the Martial Law in Pakistan on 12 October 1999. Musharraf ruled the country for 8 years ending 12 October 2007. In this era, the FDI Inflow to Pakistan was very high and it was due to many facts. President Musharraf was very strong, and visionary had sound approaches to economic and political aspects of the growth. Being a bold leader Musharraf accelerated the economic growth of the state with two things. The first one was, he enhanced the governance system, and the second one he did huge structural reforms which laid a very attractive foundation for foreign investors to invest in Pakistan. In 2005, the GDP growth spiked to 8.95 percent, which was the highest growth in the history of the country, the foreign reserve was enough to buy 6-month imports as compare to other governments. There were foreign reserves for only 3-week imports, and the foreign reserves in this era increased from $ 700 million to 17 billion. In this golden era, the Karachi Stock Exchange (Now, changed to Pakistan Stock Exchange) was declared as the best stock market in Asia, and the banking sector profitability was ranked at 3rd in Asia. All these facts provided a very pleasant and attractive environment to foreign investors, and the overall investment increased by 23% of the GDP while the Pakistan economy was financed with 14 billion of foreign direct investment. Thus, the increased foreign reserve, high GDP, and high FDI inflow contributed a lot to the financial development in the era of dictatorship from 1999 to 2007.

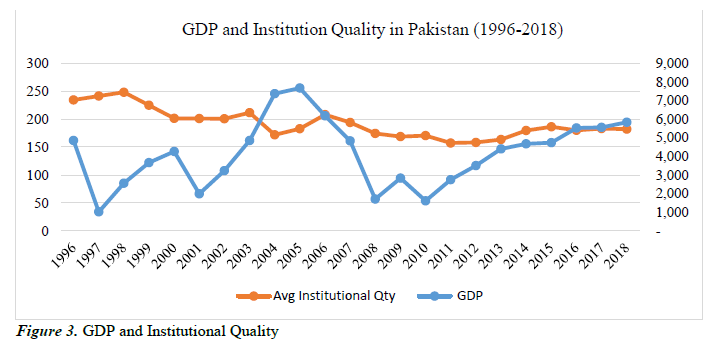

FDI and Institutional Quality

Figure 2 indicates the FDI and Institutional quality nexus in Pakistan from 1996 to 2018. The FDI pattern and Institution quality from 1996 to 2001 show a declining trend, which depicts that both institutional quality and FDI are decreasing. From 2003 to 2007, there is an upward trend witnessed in terms of both, but the FDI curve is sharper than institutional quality. Again, it was the Musharraf era where he brought in many structural changes to entice investors across the globe. The new accountability institution was established, called the National Accountability Bureau (NAB). The main purpose of this Bureau was to keep a strong check and balance on the political and bureaucrats’ misuse of national resources and to oversee corruption. This was the main milestone that increased accountability and enhanced institutional quality and made the Pakistani soil attractive to foreign investors. Besides, another institution was established called the National Reconstruction Bureau (NRB). The main purpose of NRB was to improve the overall governance system of the country, third, complete independence was given to media. All these elements boosted the investor’s confidence and attracted FDI to Pakistan, but after 2007 in the President Zardari era, the institution quality was damaged and the FDI inflow dropped again. The graphs reveal the change in various regimes i.e. the political and dictators (National Commission for Government Reforms, 2008).

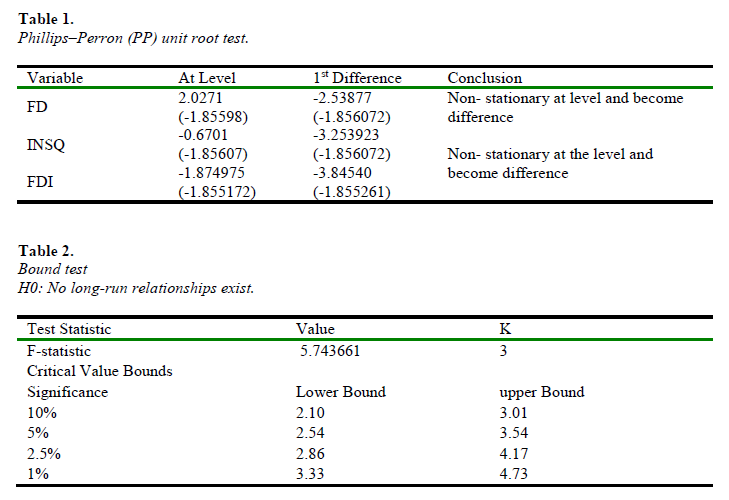

GDP and Institutional Quality

After the establishment of the NAB and NRB, the Institution quality first declined due to structural changes and strong governance mechanisms, but afterward, it started to increase from 2004 to 2007. It was a result of NAB, NRB, and structural reforms. The GSP of Pakistan showed a drastic increase from 2001 to 2006. The increase in GDP was characterized due to the result of Pakistan's favourable and consistent policies regarding privatizations, deregulations, trade liberalization, strong governance system, and institutional reforms. The large scale manufacturing was boosted from 3.6% in 1990-2000 to 11.31% in 2000-2007, and the stability of Pakistan currency against other major currencies of the world, the foreign reserve of 17 Billion, per capita income of Pakistan increased from 526 in 1999-2000 to 925 in 2006-2007, the tax and revenue collections increased from 308 billion in 1999 to 846 billion in 2007, FDI of previous eleven years from 1988-1999 was 4.87 billion, which increased to 13.195 billion in 2007, loan of 11.454 billion was given to small enterprises and 596.44 billion to the agriculture sector. Total remittances in 1998-99 were $ 1.06 billion which increased to 5.5 billion in 2006-7. All these factors among the leading forces that boosted the GDP in the dictator’s era. The graph very clearly indicates the differences between the two regimes i.e. political and dictatorship.

Baseline ARDL Estimations

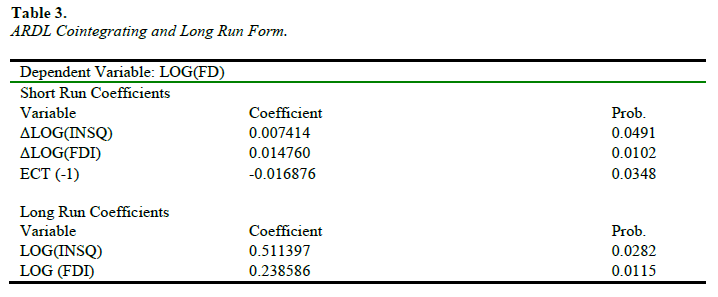

This section demonstrates the results of the baseline ARDL estimations. In this part, we apply ARDL in three phases. In the first phase we estimate equation, in the second phase, we use the lag values in the F-statistics to calculate for the bound test, but once bound test validates and verify the existence of a long-run relationship in variables then in the final phase we continue with long run assessments and error correction model. Table-1 indicates Phillips and Perron (1988) unit root test although Phillips–Perron (PP) unit root test doesn’t have very stick order of integration limits for the contained variables, however, one of the requirements involves, is no variable should be at order 2. To know stationary properties predicted by the model, we use the PP test and the results portray that all variables are stationary at level and no variable is non-stationary at the second difference (See Table 1). The bound test results predict that the F-values are above the upper bound which show the presence of long-run relationship (See Table 2).

Table 3 displays the long run and short-run estimates for our model, the short-run coefficients are shown under the error correction model. Normally variables that attain long-run equilibrium may deviate from the long-run equilibrium, therefore, to capture short-run deviation we use error correction term ECT (-1). Our short-run findings suggest that institution quality has a positive and significant effect on financial development. In each year one percent increase in the institutional quality leads to increase FD by 0.7 percent. Similarly, FDI also positively and significantly associated with FD and a one percent increase in FDI inflow leads to 1 percent increase in financial development. The error correction term shows a negative and significant coefficient which implies that our model holds a convergence property and it shows that in each year ECT (-1) converges toward long-run equilibrium by 1 percent. The long-run results are like short-run coefficients; institution quality is positive and significantly influence the financial development. The coefficient shows that a one percent increase in institutional quality increases financial development by 51 percent. Similarly, FDI also reports a positive and significant coefficient, and a one percent increase in FDI increases financial development by 23 percent. We also find that long-run coefficients show a higher value as compare to short-run coefficients, which indicates that institutional quality and FDI are comparatively higher in impact on financial development in the long run.

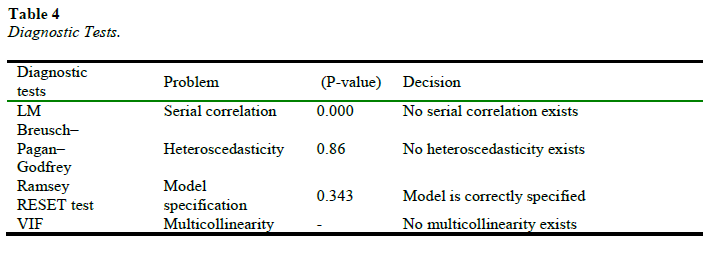

Diagnostic Test

Table 4 offers the confirmation of prior outcomes and it categorizes any fault that occurs in our outcomes; for example, the issue of Autocorrelation which mostly occurs in time-series study. Model stability that further reinforces our analyses, a relevant test is applied to notice the issue of autocorrelation in our main model by using the LM test. The autocorrelation results suggest no issue of autocorrelation. Breusch-Pagan-Godfrey reports that there is no issue of heteroscedasticity in the model. Ramsey RESET test recommends that the practical model is properly stated. VIF test indicates the non-existence of multicollinearity. All the diagnostic tests point out that our empirical results deliver a valid estimate and the model has no serious flaw.

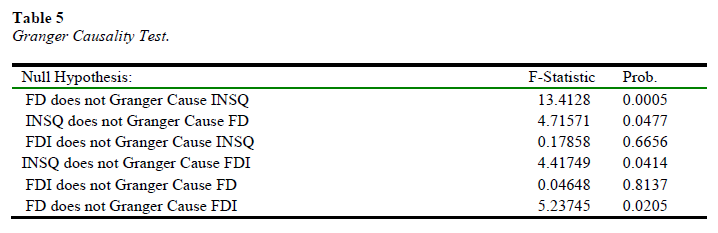

Robustness Test

For further confirmation of the baseline ARDL model estimates, we applied Granger Causality test Granger (1969). Table 5 displays the outcomes of Granger Causality and we originate a bidirectional causality between financial development and institutional quality as the F-statistics are significant in both cases. The Granger results also determine a unidirectional causality between FDI and institutional quality, running from institutional quality to FDI. There is also a unidirectional causality observed between FDI and financial development, running from FD to FDI.

Discussion and Conclusion

This study examines the impact of FDI and Institutional Quality on financial development in the context of Pakistan, for the period 1996-2018. To empirically examine, we apply Auto-regressive Distributed Lag (ARDL) estimator and for robustness purposes, we use the Granger causality approach.

The ARDL results show both the short-run and the long-run relationship of the variables. The short-run findings demonstrate that institution quality has a positive and significant effect on financial development in the context of Pakistan. This determines that institutional quality needs to be enhanced and reforms may be initiated to farther strengthen financial development which is a key indicator of the country’s economic growth. Our short-run results are in line with many previous studies that document positive nexus between institutional quality and financial development (Law, Tan, & Azman-Saini, 2014; Sohag, Shams, Omar, & Chandrarin, 2019). Similarly, FDI also reports a positive and significant effect on financial development, signifying the importance of FDI in developing the economy financially and economically. The same relationship has been witnessed by previous researchers (Choong & Lim, 2009; Falki, 2009). Our long-run results are like short-run coefficients that we obtained in the empirical results. In this perspective, the institution's quality also positively and significantly influences financial development (Calderón & Liu, 2003). Likewise, FDI also shows a positive significant effect on financial development in the long run. We also find that long-run coefficients show a higher value as compare to short-run coefficients, which indicates that institutional quality and FDI are comparatively higher in impact on financial development in long run (Hansen & Rand, 2006).

The empirical finding of the study shows that FD plays a more significant role in fostering FDI in a country with institutions of higher quality, lower inequality, stronger public order, and less ethnic conflict. This suggests that a strong institutional climate in the host country would lead to enhancing the positive role FD plays in its FDI. Finally Sohinger (2005) investigates that FDI also plays a significant role to enhance the quality of economic segment in the host country, the financial access, efficiency, and stability of the region. FD not only enhances FDI in the host country, but also enhance its financial feature while at the same time enhancing both quality of institutions and quantity of its financial development. Our robustness test reveals bidirectional causality between financial development and institutional quality (Calderón & Liu, 2003). Granger causality results also show a unidirectional causality between FDI and institutional quality, running from institutional quality to FDI, which validate the findings of many previous studies (Shah, Ahmad, & Ahmed, 2016). Likewise, there is a unidirectional causality observed between FDI and financial development (Kholdy & Sohrabian, 2005; Salahuddin, Alam, Ozturk, & Sohag, 2018). The result of the study is in line in many previous studies. So, it can be generalized for those countries which have similar structure and background as Pakistan.

Managerial Implications and Future Directions

Based on findings of this study, the government of Pakistan should focus on policies, which will substantiate the macroeconomic environment which could be a policy prescription for attracting FDI into the country, and the government should equally emphasize on institutional reforms, as an attempt to provide a clean environment to foreign as well as local investors. The government needs to improve the law and order situation to a greater extent in the country. It is also vital for the government to upgrade the infrastructure and institutional quality which could increase the domestic investment as well as foreign investment. State Bank may also take steps to offset the effect of financial development and make sure the available credits in the Banks for the investors.

Future researchers can use huge data span from 1965 to 2018in the context of Pakistan with many structural breaks to identify the strength and weakness of various regions since the very early era of independence of this country. Same variables can be tested for more country case to figure out the kind of relationship exists in respect to these variables intending to ascertain the exact magnitude of difference in these countries. The notable country in this regard could be Pakistan, India, and Bangladesh. Moreover, various countries of different regions can also be tested for the relationship between these variables.

Note

2019-2020 Liaoning Provincial Association for Science and Technology Innovation Think-tank project (LNkx2019-2020C23). A general Topic on Economic and social Development of Liaoning Province in 2020 (20201s1ktyb-050)

Competing interests

The author has proclaimed that there is no competing interest.

Acknowledgement

I would like to extend my gratitude to my professor Mr. Han Jia Bin for his encouragement and advice by making sure this work has been carried out in a timely and appropriate manner.