Financial literacy and access: revisiting the bridges and barriers to women entrepreneurship in Nigeria

ABSTRACT

This study analysed financial literacy and access for women entrepreneurs in Nigeria. The study is qualitative in nature and adopted an interpretive research design which employed an in-depth interviews with mainly well-informed women entrepreneurs to evaluate their interpretations and perceptions of the influence of financial access and literacy on woman entrepreneurship in Enugu Metropolis, South-Eastern Nigeria. A purposeful sampling approach comprising twenty women entrepreneurs was employed for this research. The results indicates that financial literacy was a critical factor in the growth of women-owned business, this is found especially in the business start-up phase Furthermore, our analysis revealed that revealed that financial skill is critical to the growth and smooth operation of female-owned business.

keyword

Financial literacy, Financial Access, Women entrepreneurs, Nigeria

Introduction

Financial literacy and skill is a prerequisite for women to cultivate a sense of entrepreneurship and efficiently develop their entrepreneurial activities, manage their personal and household finances and enhance their success in their entrepreneurial areas of interest. It is essential to equipping women entrepreneurs with prudent and sound financial decision making (EY, 2018; Lafortune & Tessada, 2015; Kuruvilla & Harikumar, 2018). Studies seem to take similar perspective about the place of women in the entrepreneurial ecosystem and abundantly argue that women have lower financial literacy levels compared to men in developing countries.

Financial literacy topics like budgeting, record keeping, savings and personal finance are crucial for entrepreneurial success among women (Sucuahi, 2013; Association of Chartered Certified Accountants, [ACCA], 2014). Against this backdrop, Al-Tamimi and Kalli (2009) argue that men are more financially knowledgeable than women, while a direct linkage appear to exist between low financial literacy level and low level education (Lusardi, 2008). an individual is considered to be financially literate under the presumption that the individual has the intellectual ability to find, understand, analyse, and use information associated with finances, financial products and services to make critical financial decisions European Conference on Information Literacy ([ECIL], 2017; Kimunduu, Erick & Shislia, 2016).

Besides financial literacy, access to finance is one of the main drivers of business growth. However, access to finance has been acknowledged as a barrier to women entrepreneurial activities in developing countries (Brixiová and Kiyotaki, 2016; Economic and Social Commission for Asia and the Pacific [ESCAP], 2018). Although policies and programs are growing in numbers globally which are designed to address the needs of the teaming number of women business owners as well as their enterprises, access to finance is considered the single biggest challenge facing women entrepreneurs (Eghobamien-Mshelia, 2019; Gathungu & Sabana, 2018; Khaleque, 2018). Specifically, women with special needs — less educated and low-income women groups, widows, physically challenged women and young women — appear to be more in dearth of financial knowledge and also have limited or no access to financial needs than men. Barriers to full financial inclusion of women are largely traced to their lower financial and economic activities.

Globally, labour force participation among women has dropped from 57 percent to 55 percent over the past two decades, in spite of strong evidence that economic participation of women benefits families, communities, and economies (Baalbak, 2015). It is estimated that small and medium enterprises (SMEs) with partial or full female ownership accounts for 31 to 38% (8 to 10 million) of formal SMEs in the emerging markets. Hence, since financing is an essential means by which to pursue growth opportunities, meeting specific needs of women entrepreneurs in accessing finance must be an integral part of the development agenda (IFC, 2011). It is estimated that 70 percent of women-owned small and medium enterprises are either financially unserved or underserved (Blair, 2015).

In the Nigerian context, economic activities of most women are centered on the informal sector of the economy both at rural and urban centres (Taiwo et al., 2016). Nigerian women entrepreneurs obtain informal financial support more often than financial support from formal financial institutions. For example, 42 percent of women’s finance requirements in Nigeria are met by informal sources such as family and friends, and only 2 percent are met by formal financial institutions (Baalbak, 2015; Adesua-Lincoln, 2011). Thus, Women and women-led businesses remain disproportionately excluded from the global formal financial system (Alliance for Financial Inclusion, 2017; Miles, 2017).

Literature Review

Financial literacy and access have acknowledged as major factors that influence the success of SMEs globally. Accordingly, their impact on the performance of women entrepreneurs remain on the front burner of recent literature. For instance, Kuruvilla and Harikumar (2018) evaluated the financial awareness among women entrepreneurs in selected districts in India. The authors observed that women were largely ignored in financial management and training. It was also revealed that while majority of women entrepreneurs did not receive proper education, educated ones were not literate in financial matters. The study underscored the fact that financial literacy has huge implications for a business and entrepreneurial performance since the adverse effect of an uniformed decision making for a business cannot be overemphasised.

Atandi, Bwisa and Sakwa (2017) examined whether financial literacy has enabled SMEs make informed financial decisions about savings mobilisation based on skills as well as knowledge attained in the course of a number of financial literacy trainings they received, which is considered pivotal in enhancing entrepreneurial growth. The major findings supports the perspective documented in ILO (2018) and Pandey and Gupta (2018), and showed that financial literacy trainings improved entrepreneurs’ confidence in making informed independent decisions regarding savings, setting savings goals and creating savings plans while also enhancing positive attitude about money management behaviours.

Using a search approach and empirical analysis of survey of selected entrepreneurs from Swaziland, Kangoye and Brixiová (2016) assessed gender differences in entrepreneurial performance and their relation with sourcing and utilisation of start-up capital. The results revealed that both women and men entrepreneurs with higher start-up capital record better sales outcomes compared to those with smaller start-up capital. The findings further showed that formal sources of start-up capital and finances were related to with higher sales among women entrepreneurs, but emphasized that women entrepreneurs in Swaziland, like in developing countries, have smaller start-up capital compared to men. Women entrepreneurs with college education were found to have confidence in their skills, and are more inclined to start their businesses with higher amounts of finances. The findings indicated that professional support play important role in the entrepreneurial success of women as those that enjoyed such supports are more likely to source their start-up finances from the formal financial institutions.

Sucuahi (2013) assessed the effect of financial literacy on the performance of selected 100 micro-entrepreneurs. For the most part, the study observed that the level of financial literacy of the micro-entrepreneurs were modest which reflected in the poor financial management of their resource. The multiple regression estimates further revealed a significant impact of educational attainment on the financial literacy. The result however indicated that gender may not ultimately predict the level of financial literacy among micro entrepreneurs. However, OECD (2013) contends that a relatively extensive range of empirical studies acknowledged the existence of gender differences in financial literacy in different countries and across several dimensions. On average, women seem to perform worse than men on financial skills and knowledge and tend to have less confidence in their financial skills (OECD, 2013; Guloba, Ssewanyana and Birabwa, 2017).

Lafortune and Tessada (2015) assessed the effect of offering consulting services in several formats in the case of micro-entrepreneurship training. It was found that individualised technical assistance, compared to group technical supports, appeared to have some effects on business outcomes in the short-run but without any improvement on financial or managerial techniques. However, the results provided some evidence that businesses improved significantly while financial concepts seemed to be better understood by those who received individual assistance compared to group assistance.

Kimunduu, Erick and Shisia (2016) use descriptive survey design to explore the influence of financial literacy on the financial performance of SMEs in selected districts in Kenya. The results showed that high levels of financial literacy among entrepreneurs were strongly related to higher financial performance of SMEs.

Drexler, Fischer and Schoar (2018) conducted a randomised control study to compare the effect of two different programs namely, the standard accounting training as opposed to a simplified, rule-of-thumb training which teaches basic financial skills. The results showed that simplified, rule-of-thumb training yielded significant improvements in the financial heuristics of micro-entrepreneurs, which resulted in quality service and improved revenues. These results suggested that reducing the complexity associated with training programs is critical is improving the effectiveness among micro-entrepreneurs.

Adesua-Lincoln (2011) analysed the influence of finance for start-up and growth as the key factor affecting women entrepreneurs. The study was conducted in the context of Nigerian women entrepreneurs using a survey of 132 women-owned businesses. The findings showed that women entrepreneurs in Nigeria are mainly constrained by their weak financial standing and lack of collateral. Most of the women entrepreneurs resort to internal finance sources for their start-up capitals. The finding revealed that gender is immaterial to the practices of financial institutions in their dealings with women entrepreneurs.

Khaleque (2018) examined whether access to finance really matter in the performance of women entrepreneurs in Bangladesh. The study used the descriptive and econometric techniques in the analysis. In line with Miles (2017), the results suggested that the credit constraints as well as credit size have some effects on the monthly turnover of female entrepreneurs. When credit constraint is relaxed, monthly turnovers increased by 6 percent. The paper highlighted that relaxation of credit constraints have significant positive impact on the business performance of women entrepreneurs. To this end, Imhonopi, Urim and Ajayi (2013) and Chamani, Kulathunga and Amarawansha (2017) suggested that the existence of constraints to finance such as collateral and cultural limitations have impeded the growth and success of women’s entrepreneurial ventures till date and must be relaxed.

Taiwo et al., (2016) examined the impact of financing women entrepreneurs and employment generation for women in Nigerian. The paper argued that financing women entrepreneurs is positively associated with employment generations by improving in their business activities.

International Development Research Centre (2018) explored existing evidence on the evolution of fintech in Africa, and how it is changing the financial landscape and success of women entrepreneurs. The paper underscored the potential benefits of fintech for women and the financial inclusion, and argues that emerging technologies should be better tailored to address specific barriers that African women in the accessing finances. International Development Research Centre (2018) contends that higher financial inclusion through fintech has been observed to be significantly correlated with income inequality and poverty reduction.

Lincoln (n.d) examined gender related challenges encountered by women entrepreneurs in the Nigerian. The study employed a mixed method approach which involves the use of interviews and questionnaires administered to women entrepreneurs from diverse sectors in Lagos. The finding showed that women entrepreneurs in Nigeria operate in an unfavourable business environment characterized by poor infrastructural deficiencies, limited access and high cost of finance, corruption and weak institutions. The highpoint of the finding was that women entrepreneurs in Nigeria do not have equal opportunities as their male entrepreneurs (see also Sanusi, 2012; Kaur, 2017).

Data and Methodology

This study is basically interpretive in nature (Jamali, Sidani & Safieddine, 2005), and relies on in-depth interviews with mainly well-informed women entrepreneurs to evaluate their interpretations and perceptions of the influence of financial access and literacy on woman entrepreneurship in Enugu Metropolis, South-Eastern Nigeria. Patton (2002) maintains that interpretive research design is qualitative and primarily seeks to discover collective points of reference that guide the ascription of meaning and help account for how women construe or interpret their own realities. A purposeful sampling approach comprising twenty women entrepreneurs was employed for this research. In-depth emphases of qualitative analysis typically centers on relatively small samples which are purposefully selected (Patton, 2002). The sampling approach was purposeful in the sense that only women with relevant entrepreneurial experience were selected. The sampled entrepreneurs have attained at least basic level of education, are experienced with start-up business/or venture capital with at least 2 employees and 6 years entrepreneurial experience.

We prepared an interview guide based on the reviewed literature. The interview guide addressed financial access, financial literacy, financial skill and barriers to financing, and how they affect women entrepreneurship. The interview guide helped to steer in-depth discussions around common themes (relating for example to financial access, financial literacy, financial skills, constraints and barriers to women entrepreneurs, mentoring, financing strategies, motivation, performance, and economic environment), while also allowing the interviewee to choose the wording as well as sequence of questions during the interview. All interviews were conducted in English and Igbo Language (occasionally used when contextual clarifications are demanded by the interviewee with a confirmatory question in Igbo Language, or when the interviewer probed for clarity and understanding). Interview question lasted on average 2 hours, and were audio recorded and transcribed.

Research Findings

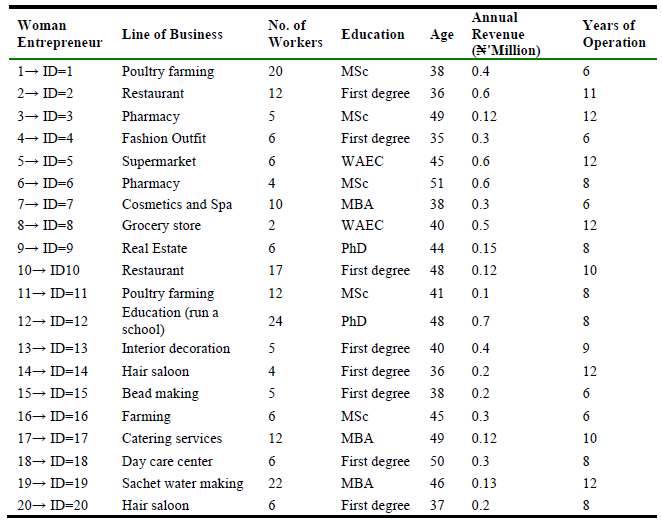

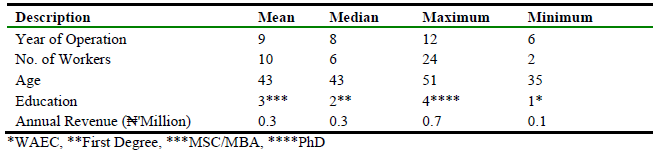

In this paper, women entrepreneurs were the only participants. Sample profile in Table 1 shows that the female entrepreneurs cut across different age groups, business sectors, and educational qualifications thus bringing to bear the diverse vintage points as well as perspectives associated with woman entrepreneurs in Metropolis. Summary statistics in Table 2 reveals that the age of the selected entrepreneurs ranged between 35-51 years and averaged 43 years. The average years of operation were 9, where the minimum was 6 years and the maximum was 12 years. The average academic qualification in the sample was MSC/MBA/First Degree – for instance, 8 had MSC/MBA, 8 had First Degree, 2 had PhD and 2 had WAEC certificate. The number of employees averaged 9, and the minimum number of employees was 2 while the maximum was 24. Average annual revenue of the women entrepreneurs was ₦3 million, and ranged between ₦1 million and ₦7 million.

Table 1. Sample Profile.

Table 2. Summary Statistics.

Financial Literacy and growth of Women-led entrepreneurship.

The results indicate that financial literacy was a critical factor in the growth of women business, especially in the business start-up phase. The financial literacy aspects were explored, including education, experience and financial skills. Women entrepreneurs with prior entrepreneurial experience were likely to be more skilled and also most likely to effectively manage both business resources and human capital. With growing experience in the diverse business sectors, they gradually garner knowledge, skill and experiences related to running a business. 31% of the participants linked financial literacy to effective financial management, 22% associated it to profit maximization while 36% experienced that financial literacy is critical for business growth while about 10% stated that financial literacy is essential for informed decision making. Some participants expressed broad view of financial literacy with a more encompassing line of thought. For instance, ID=12, who is one of the two with highest academic qualification, stated that “financial literacy has facilitated the growth of women owned enterprise in the area of viability. This is because it enables us take responsibility our finances, and helps us maintain a sharp focus on cost and management of cash flows which is geared at maximizing profit and enhancing business growth and survival”. ID=16 was of the view without financial literacy, “managing and sustaining their business will be difficult”. These findings are in line with Sucuahi (2013), Atandi, Bwisa and Sakwa (2017), Guloba, Ssewanyana and Birabwa (2017), Kuruvilla and Harikumar (2018), and Abubakar (2015) which highlighted the implications of financial literacy on business and entrepreneurial performance in Africa. Moreover, Kimunduu, Erick and Shisia (2016) argued that high levels of financial literacy among entrepreneurs were strongly related to higher financial performance of SMEs.

The results further revealed that financial skill is critical to the growth and smooth operation of female-owned business. Commonly highlighted skills by the participants included basic accounting and book keeping, budgeting and financial management, fund raising and allocation, loan management, investment and people management. There is a consensus among the participants that lack of financial skill is a daunting challenge which does not make the acquisition and management of capital/resources any easier for female business owners. This supports the perspectives of OECD (2013) and Guloba, Ssewanyana and Birabwa (2017) who asserted that, on average, women seem to perform worse than men on financial skills and knowledge and tend to have less confidence in their financial skills. However, Kuruvilla and Harikumar (2018) buttressed that while majority of women entrepreneurs did not receive proper education, educated ones were not literate in financial matters. This underscored the need for financial literacy/skill training program tailored for women. In view of this, Drexler, Fischer and Schoar (2018) argued for the simplification and reduction of the complexity associated with training programs as this is critical in improving the effectiveness among (women) entrepreneurs.

Financial Access and growth of Women-led entrepreneurship.

The results seem to overwhelmingly suggest that financial access is key to the survival and sustainability of women business, and lack of which remains a huge setback to entrepreneurial success of women-owned businesses. For instance, ID=5 who was one of the 2 participants with lowest academic qualification stated that financial access “is very essential because finance is the very heart of any business enterprise. D=15 expressed:

Easy access to finance is very important because if women have access to financing their business, diversification and growth will be easy, this is my case because when I started my business I had little or no access to credit but with a little financial help, I was able to expand my business.

In general, women face considerable barrier to financial access with 50% of the participants asserting that lack of collateral and financial literacy were the major constraints they faced in accessing funds from informal financial institutions. When asked what major barrier keep women form having access to finance and financial services? ID=11 responded that “nature of the business, inability to bear financial risk, and lack of collateral” constitute major constraint. Similarly, ID=1 maintained that gender inequality, lack of collateral and lack of financial literacy is a major barrier to financial access. D=12 explained that “not being financially literate, and lack of mentors are among the main barriers. This seem to be supported by Imhonopi, Urim and Ajayi (2013) and Chamani, Kulathunga and Amarawansha (2017) who found that the existence of constraints to finance such as collateral and cultural limitations have impeded the growth and success of women’s entrepreneurial ventures till date.

Although 30% of the participants argued that social constraints and gender inequality are barriers to women entrepreneurs, 60% of them were of the view that women do not necessarily face discrimination and disadvantages compared men in accessing financial capital. This contradicts Kungwansupaphan and Leihaothabam (2015) which observed that women-led businesses face considerably greater discrimination than men counterparts accessing funds. However, in line with our finding, Adesua-Lincoln (2011) observed that gender is immaterial to the practices of financial institutions in their dealings with women entrepreneurs, although the author appeared to agree that women entrepreneurs in Nigeria are mainly constrained by their weak financial standing and lack of collateral. To this end, it could be argued that that gender may not ultimately predict the level of financial literacy among women entrepreneurs which has been observed to be strongly associated with success in accessing financial capital (see Sucuahi, 2013).

Conclusions

Research has shown that women own nearly half the country’s micro enterprises and 20% of small and medium-sized businesses, female entrepreneurs accounted for 43.32% in the ownership structure of micro enterprises as against 22.75% in small and medium enterprises (2013, SMEDAN/NBS MSME Survey Report). From our research findings, it is obvious that women entrepreneurs with prior entrepreneurial experience were likely to be more skilled and also most likely to effectively manage both business resources and human capital. With growing experience in the diverse business sectors, they gradually garner knowledge, skill and experiences related to running a business. It was also noted that financial literacy has facilitated the growth of women owned enterprise especially in the area of viability. Moreover, it was observed that financial skill is critical to the growth and smooth operation of female-owned business. These skills includes basic accounting and book keeping, budgeting and financial management, fund raising and allocation, loan management, investment and people management. This they believe poses a great challenge to the future growth of their business. Lately, Nigerian women are becoming entrepreneurs at a very high rate than men counterparts.

At the moment, it is seen that women are playing more and more important role in making wealth and jobs for the country. Many federal government sponsored loan programs for small businesses exist in the country, especially those that are geared towards encouraging women entrepreneurs in Nigeria. However, from our research and others, women entrepreneurs across the country have identified several significant barriers to accessing finance to start or grow their business. Due to lack of adequate financial literacy, women entrepreneurs do not apply for business loans basically because of lack of adequate information, collateral, unclear application process and some bureaucratic tendencies. This means that the majority of Nigerian women entrepreneurs lack proper access to finance. There is a need to simplify the trainings in other to make the skill to be acquired easy especially for the less educated ones. This is in line with the views of Drexler, Fischer and Schoar (2018) who argued for the simplification and reduction of the complexity associated with training programs as this is critical in improving the effectiveness among (women) entrepreneurs. It is recommended that there should be funds that are set aside for additional investment in women financial literacy initiatives in Nigeria and also make simple the process through which women entrepreneur obtain loan. There is a need to set up an agency that should take charge of regular review of all the processes and requirement for access to loan and grants for women entrepreneur with a view to ameliorating the challenges they face and enhance their access to finance; when this happens, they have strong chances of growing their businesses and having better change of expansion and success. Going by the recent statistics of women occupying up to 43.32% in the ownership structure of micro enterprises, it is seen that a developing country like Nigeria can only achieve its economic prospect when a greater number of women entrepreneurs flourish, and this can be achieved through adequate financial literacy and access.