Modeling of production processes in rural areas:

management and development effectiveness

ABSTRACT

In the modern economy, the process of studying independent and alternative approaches to studying a business (organization) is happening more and more. Such alternative approaches of today include: “neoclassical theory”, “theory of transaction costs” (theory of specific assets), “theory of incomplete contracts” (theory of property rights), and also “agent theory” (theory of incentives). Such integrated systems and approaches of economics and management as “resource theory”, “knowledge theory”, “strategic theory”, “entrepreneurial theory”, “network theory”, “theory of resource dependence”, “theory of institutional isomorphism”, “theory of situational choice", "The theory of strategic choice" is currently promising and relevant. The article discusses the basic model of neoclassical theory. The main superiority of this theory is expressed in the fact that it predetermines the technological component as a whole as an economy in the broad sense of the understanding and depends on the scale of activity of the economic entity. Moreover, this theory provides for the reflection of savings in the activities of an economic entity, taking into account the scale of activity and business processes (factors) that characterize the volume of production and turnover of organizations. In the framework of the approach under consideration, a certain macrostructure is determined that incurs costs of economic resources: fixed assets, the number of employees that affect the turnover of organizations. The rational management task that the Udmurt Republic encounters is to determine the forecast for the turnover of organizations for given resources and in calculating the fixed assets necessary for its value and the number of employees. It was revealed that the rural economy of Udmurtia has a negligible effect on the scale of resources, since with a simultaneous increase in labor and capital by 1%, the turnover of organizations increases by 1.82%, and the final product is most dependent on the state of the workforce, as the current state the equipment used is in critical condition in terms of wear and efficiency.

keyword

modeling, integrated research, forecasting, assessment

Introduction

In the modern economy, the need has arisen for the application of new integrated systems and approaches for the determination of macrostructures of an economic entity (Kontsevaya, 2017).

The macrostructure of the economic subject, taking into account the functions of economic indicators, production indicators and other functional and technical indicators show the integrity of the organization (Frantsisko, Ternavshchenko, Molchan, Ostaev, Ovcharenko and Balashova, 2020). The problems of evaluating the effectiveness of the functioning of the system and the use of individual production factors in economic entities and in individual regions of the country are highlighted in the works of domestic scientists and economists (Ivashkevich, Gareev and Shayukov, 2018; Kostyukova and Bobryshev, 2016; Trukhachev, Kriulina, and Tarasenko, 2008; Shafronov, 2015; Sheremet, 2009; Alborov, Kontsevaya, Klychova and Kuznetsovd, 2017; Kislyakova, Berezkina, Vorobyeva, Kokonov and Strelkov, 2019).

The production function is a statistically significant relationship (technological connection) between the total output (income) and the amount of resources used (Hassani, 2012; Glebova, 2017).

Production functions can be defined for production systems of various scales - from the production site to the global economy. Each production system is characterized by its own production function (Khosiev, Ostaev, Kontsevoy, Suetin, Sokolov, Antonov and Suetin, 2019).

The apparatus of production functions is widely used in microeconomic and macroeconomic analysis in modeling production processes (Kokonov, Khosiev, Valiullina, Ostaev, Ryabova and Gogaev, 2019; Ostaev, Gogolev, Kondratev, Markovina, Mironova, Kravchenko and Alexandrova, 2019). Using production functions, it is possible to evaluate the effectiveness of the functioning of the system and the use of individual production factors, determine the possibilities and consequences of replacing some production factors with others, find the influence of the scale of production on its efficiency, and study the impact of managerial and technological innovations on production processes (Kondratie, Ostaev, Osipov, Bogomolova, Nekrasova and Abasheva).

Methodology

Finding a production function for a real production system is a problem that is solved by statistical methods for processing empirical data. In general, the production function can be written as follows:

![]()

where![]() – issue size;

– issue size; ![]() –amount of j-th resource

As a rule, the assumption is made that the structure produces only one product and its production function is continuously differentiable.

–amount of j-th resource

As a rule, the assumption is made that the structure produces only one product and its production function is continuously differentiable.

Next, we consider the concept of a substitution curve, an indifference curve for manufacturers - isoquants. An isoquant is a curve that shows all possible combinations of factors of production that provide the same volume of production. The introduction of isoquants is that they clearly show the possibility of replacing one factor of production with another.

Isoquants have the following properties:

- isoquants do not intersect with each other;

- isoquants in the field of definition of the production function (economic field) have a negative slope and are concave with respect to the origin;

- a larger output corresponds to an isoquant, more distant from the origin;

- if all resources are absolutely necessary for production, then isoquants do not have common points with the coordinate axes.

To quantify the rate of change of the marginal rate of substitution along the isoquant, the concept of the elasticity of the substitution of resources is used. The elasticity of the substitution of resources has the following economic meaning: it approximately shows how many percent the ratio of resources should change when moving along the isoquant, so that the marginal rate of substitution γchanges by 1%. The elasticity of substitution characterizes the curvature of the isoquants.

In the case of homogeneous production functions, the elasticity of the substitution of resources can be determined by the formula

![]() (2),

(2),

where ![]() – degree of homogeneity.

– degree of homogeneity.

Next, we consider one of the types of production functions, a power-law production function, the Cobb-Douglas production function.

A power production function with ![]() resources has the following form:

resources has the following form:

![]() (3),

(3),

where ![]() – output volume,

– output volume, ![]() – the number of the

– the number of the ![]() th factor,

th factor, ![]() – positive parameters (

– positive parameters (![]() for all j =1, 2,…, n).

for all j =1, 2,…, n).

The most famous type of production function is the Cobb-Douglas function:

![]() (4),

(4),

where ![]() – the volume of production assets (capital) in value or kind,

– the volume of production assets (capital) in value or kind, ![]() – the amount of labor in value or kind,

– the amount of labor in value or kind, ![]() – is the output in value or kind,

– is the output in value or kind, ![]() are constant values.

are constant values.

If ![]() , then the Cobb-Douglas function satisfies all the above requirements for production functions.

, then the Cobb-Douglas function satisfies all the above requirements for production functions.

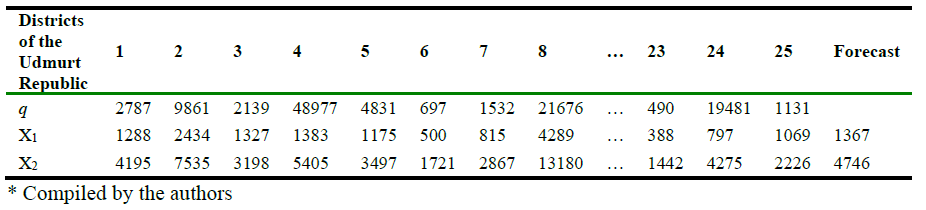

Modern processes of economic development of municipalities require consideration of the processes of development efficiency from the scientific point of view of economic and mathematical modeling (Baranov, 2014; Chazova and Mukhina, 2019). We carry out a comprehensive study of the Cobb-Douglas function. Table 1 shows data on the turnover of organizations ![]() , the value of fixed assets

, the value of fixed assets ![]() , the number of employees

, the number of employees ![]() for the year in the Udmurt Republic. Using the source data, you need:

for the year in the Udmurt Republic. Using the source data, you need:

1) determine the parameters of the Cobb-Douglas production function ![]() ; (5),

; (5),

2) calculate the basic economic and mathematical characteristics of the production function;

3) to predict the turnover of organizations for given average values ![]() ;

;

4) to build isoquants for indicators of the turnover of organizations:

a) for given average values ![]() ,

,

b) by reducing the set values by half.

Table 1. Data for the Udmurt Republic for 2017 (Statistical digest. Udmurtstat)

.PNG)

Results and discussion

For management purposes and the effectiveness of rural development, it is necessary to analyze existing data for the Udmurt Republic. We believe that the Cobb-Douglas function for managerial decision making is highly relevant.

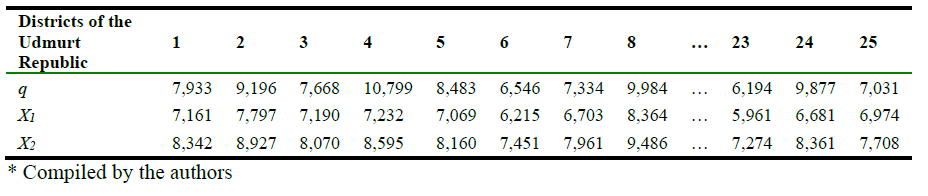

Table 2. Input data for constructing the Cobb-Douglas function.

Table 3. Prologarization source data.

Decision

Definition of unknown parameters ![]() of the production function.

of the production function.

We program the Cobb-Douglas function:

![]()

Let ![]() then in the new notation we get:

then in the new notation we get:

![]() (7),

(7),

Thus, having obtained a linear function, we determine the unknown parameters ![]() using the least squares method and using the Excel software product.

using the least squares method and using the Excel software product.

The obtained parameter values ![]() satisfy the requirements

satisfy the requirements ![]()

![]() =

=![]() =

=![]() = 0,001.

= 0,001.

Reliability of the approximation of the obtained Cobb-Douglas production function equation

![]()

High enough is ![]() .

.

II. Determination of economic and mathematical characteristics of the Cobb-Douglas production function ![]() (8),

(8),

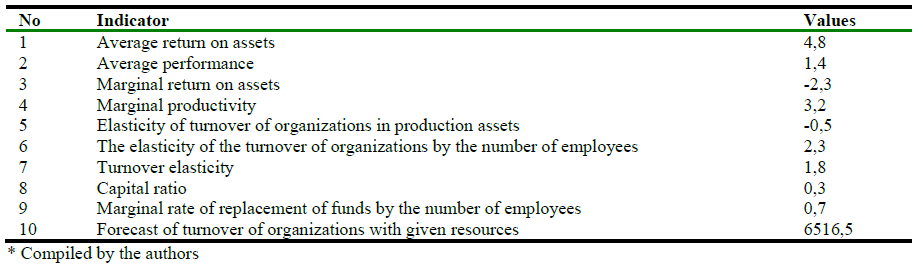

Table 4. Economic and mathematical characteristics of the Cobb-Douglas function

1. The average capital productivity at ![]()

![]()

With an increase in the value of fixed assets ![]() (with a constant number of employees

(with a constant number of employees ![]() ) the average capital productivity decreases. The increase in the number of employees

) the average capital productivity decreases. The increase in the number of employees ![]() (at a constant cost of fixed assets

(at a constant cost of fixed assets ![]() ) leads to an increase in the turnover of organizations.

) leads to an increase in the turnover of organizations.

2. Average performance at ![]() :

:

![]()

3. Marginal return on assets at ![]()

![]() ,

,

Thus, with an increase in the value of fixed assets (at constant values of the number of employees), the marginal return on assets decreases. An increase in the number of employees (at constant values of the value of fixed assets) leads to an increase in marginal return on assets. A simultaneous change in both variables can lead to different results. If ![]() .

.

Thus, with an increase in the value of fixed assets (at constant values of the number of employees), the marginal return on assets decreases. An increase in the number of employees (at constant values of the value of fixed assets) leads to an increase in marginal return on assets. A simultaneous change in both variables can lead to different results. If ![]() .

.

4. Marginal labor productivity at ![]() :

:

![]()

If ![]() then the average labor productivity is also higher than the marginal one, that is,

then the average labor productivity is also higher than the marginal one, that is, ![]() .

.

5. The elasticity of the turnover of organizations in production assets:

![]()

This indicator indicates that with an increase in spending on funds by 1%, the turnover of organizations decreases to the utmost by 0.49%.

6. The elasticity of the turnover of organizations by the number of employees:

![]()

7. Turnover Elasticity:

![]()

8. Capital-labor ratio (the volume of funds per one unit of labor) at ![]()

![]()

An increase in the number of employees (at constant values of the value of fixed assets) reduces the capital-labor ratio, and an increase in the turnover of organizations leads to an increase in the capital-labor ratio if the volume of use of labor resources has not changed.

9. The marginal rate of replacement of productive assets by the number of employees at ![]()

![]()

10. The elasticity of the replacement of resources is determined by the formula:

![]()

For the Cobb-Douglas function with a degree of homogeneity ![]() we get

we get ![]()

Thus, a change in the capital-labor ratio of 1% corresponds to the marginal rate of substitution also by 1.8%.

III. Definition of the forecast of the turnover of organizations with ![]()

Using the found values of the parameters of the Cobb-Douglas function and the initial cost values, we obtain the forecast value of the turnover of organizations:

![]() = 6517

= 6517

![]() = 1848

= 1848

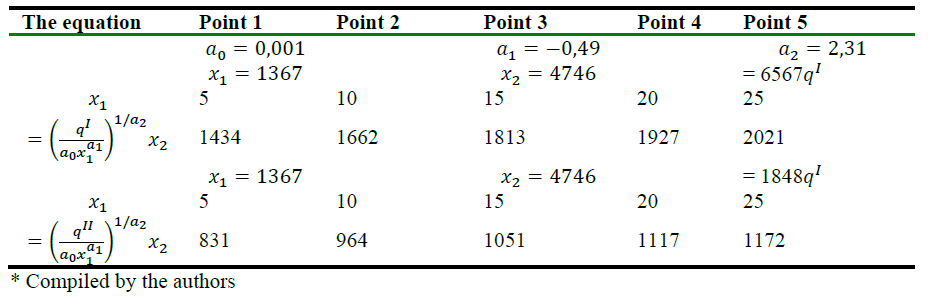

IV. Construction of isoquants. The isoquant equation has the following form:

![]()

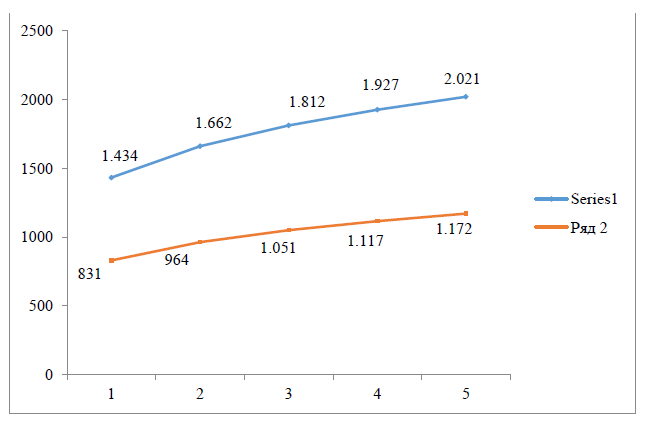

Substituting into the control of isoquants the values of the parameters of the production function for various values of the level of turnover, we build graphs (Fig. 1).

Table 5. Modeling the volume of revolutions

Figure 1. Isoquants of the production function of the Cobb-Douglas (compiled by the authors)

Conclusions

For the economy of rural municipalities of the Udmurt Republic, the dependence of the turnover of organizations ![]() (as a result of production activity) on the value of fixed assets

(as a result of production activity) on the value of fixed assets ![]() , number of employees

, number of employees ![]() is described by the Cobb-Douglas production function equation

is described by the Cobb-Douglas production function equation

![]()

Based on the coefficients, it was revealed that the combined effect of the two factors is 1.82 (-0.49 + 2.31). This means that the rural economy of the Udmurt Republic has a negligible effect on the scale of resources, since with a simultaneous increase in labor and capital by 1%, the turnover of organizations increases by 1.82%.

The average capital productivity was determined, which amounted to 4.8 rubles of turnover per 1 rubles of fixed assets. The average labor productivity amounted to 1.4 million rubles. for 1 working. Accordingly, at the given average values, the forecast for the production and sale of the product (turnover value) was calculated, which can reach a maximum value of 6,517 million rubles per region or 162.9 billion rubles in the economy. With available resources more than this value, the result is not yet achievable.

According to the value of the parameter A = 0.001, a very low influence of technological progress in the rural economy of the Udmurt Republic was revealed. It is generally accepted that an increase in the value of A indicates an increase in the output of the product with previous quantities of labor and capital. The low efficiency of the technologies used also reflects the effect of the law of diminishing returns on factors, which showed that with an increase in the cost of funds by 1%, the turnover of organizations decreases to the utmost by 0.49%.

The rural economy can be called laborious. The most significant factor is the number of employees, and their productivity (Kontsevaya, Сhachotkin, Kostina and Khoruziy, 2019). Enterprises should increase their average labor productivity by almost 2.2 times (to the level of marginal labor productivity of 3.2 million rubles per person).

On the one hand, this is due to the specifics of agricultural production, in which labor costs are always significantly higher than in other sectors. But with the current level of technology, it is not realistic to increase labor productivity. Modern enterprises have very high depreciation of equipment (more than 60%), so the real return on the equipment used is low, and the final product is more dependent on human resources.

We need a new qualitative leap in the innovative and investment development of the rural economy, a review of the real state of physical capital acquired by economic entities of the agro-industrial complex.

The results obtained are recommended to guide the economic activities of enterprises in the municipal regions of Udmurtia, municipal authorities to analyze the state of production development and develop measures to regulate economic support, for regional governments to formulate investment development programs and evaluate the effectiveness of business projects subject to subsidies from the state.