The underground economy in transition countries from the perspective of globalization: The case of Vietnam

ABSTRACT

The underground economy, also known as the shadow economy, has been recognized for a long time and increasingly plays an important role in economies around the world, especially for developing countries like Vietnam. Over the past few years, the strong growth of the Vietnamese economy has recognized the development and significant contribution of informal economic activities. This study was conducted to evaluate the effects of globalization and economic openness on the size of the informal economy to fill the theoretical gap and proposed appropriate recommendations for policymakers. The research uses qualitative and quantitative analysis methods. We collected KOF Globalization Index from ETH Zurich - Swiss, the trade index from World Bank and the size of the underground economy in Vietnam from the research of Medina and Schneider (2018) for analyzing. The results show that the trade openness has a positive impact on the development of globalization in Vietnam. Also, the promotion of globalization plays a vital role in reducing the size of the underground economy in Vietnam. Several implications for policy makers has been proposed based on our findings.

keyword

Underground economy, trade openness, shadow economy, globalization, international integration

Introduction

The underground economy is intrinsically difficult to control because agents involved in underground economic activities always find ways to not be detected by authorities. However, the demand for information on the extent of the underground economy and its expansion over time is concerned by its impact on politics and the economy as a whole (Medina & Schneider, 2018). Understanding the whole economic activity, including the production of formal and informal goods and services, is essential for the formulation of economic policies to cope with increasing fluctuations. Moreover, the size of the underground economy is an important input for policy makers estimated the degree of tax evasion of all sectors in the economy and therefore may put off the decision to bring the underground economy into the control.

Currently, the government is paying close attention to the underground economy because of its profound impact on the whole economy and the intention to start a business in Vietnam. Specifically, the government has made a requirement to evaluate the level of the underground economy and provide accurate figures, thereby aiming to bring the total value of the underground economy to Vietnam's total GDP from 2020 (Xuân, 2019). We conduct this study to understand the important role of the underground economy, a concept that is often misunderstood or misquoted. Based on the research of studies on shadow economy in the world, we used quantitative methods to evaluate the effects of trade openness and globalization on the size of the underground economy in Vietnam.

This paper aims to answer the following two research questions: What is the underground economy? How does a country's trade openness and globalization affect the size of its underground economy? In context of the ongoing China-US trade war, this study provides a different perspective on the possible effects of de-globalization in increasing the scale of the underground economy. The research results will serve as a valuable reference for policy makers.

Literature review

a) Underground economyAccording to the OECD research (2002), unobserved economic sectors include underground economic activities, illegal economic activities, informal economic activities, and autonomous economic activities, self-consumption by households. In addition, economic activities omitted due to the defect of the statistical survey program are also considered as unobserved economic activities. Unobserved economic areas are classified into five areas as follows:

Underground production activities: Is the legal production activities but intentionally conceal the authorities in order to reduce the payable tax (value added tax or income tax) or reduce the contribution to social insurance as prescribed by law, or to avoid registering and recording in administrative surveys or statistical questionnaires. Apart from the term “production underground”, some countries use different terms to refer to operations of this type as “operation hiding”, “veiled economy”, “informal economy”.

Informal production sector: Being legal production activities but with a low level of organization of production, no legal status, no business registration, products produced can be sold on the market. It is the characteristic of small goods and service production units in the household sector.

Household production for subsistence consumption is the productive activity of a household that creates physical products for self-consumption or accumulation, which are also in the non-amorphous manufacturing sector.

Illegal production: Manufacturing activities that create goods and services that are prohibited by law or that become illegal products and products manufactured by illegal manufacturers. This group includes unregistered production units and also entities that have registered business in lawful trades but do not do business under the registered operation. This group is considered unregistered.

Household production “self-consumption”: Goods and services produced in the household for self-consumption.

Activities omitted by statistics: goods and services that should have been included in statistics should be ignored by statistical agencies.

b) The cause of the underground economyA lot of research has been done to find out what causes the increase in the size of the underground economy in the world. The main reasons are as follows:

Tax burden and social security: One common point in many studies that tax burden and social security contributions is one of the most important causes of the size of the underground economy. In a country with a higher tax rate, the lower the voluntary tax payment of individuals and businesses, it encourages workers to withdraw from the formal economic sector and join the underground economic sector to escape tax. Moreover, taxes and social security impacts a lot on after-tax income. The more donations, the income received by the workers and businesses lower, since their incentive to take part in the underground economy as large (Schneider et al, 2000; Torgler et al, 2009). In another view, Hirschman (1970) argued that the increasing number of workers and businesses who came to the underground economic sector could be seen as their reaction to the overload of the tax burden, heavy security. It is an alternative to speaking up that requires a change in government policy. This problem is like a vicious circle because the increase in the shadow's scale economy causes the government to reduce budget revenues. To compensate for the lack of budget to maintain the quality of public services, the state must raise tax rates higher in the formal economic sector, thereby encouraging the underground economy to develop.

Per capita income: This high index will reduce the proportion of cash in the economy (Cagan, 1958). The economic growth represented by the increase in per capita income will reduce people's cash demand, non-cash transactions will gradually replace cash payment activities.

The quality of regulatory institutions: The quality of state institutions is also an important factor in the expansion of the informal sector. A government with corrupt officials tends to involve greater informal activity, while transparent laws through securing ownership and enforcing contracts increase benefits of formal economic activities. Production in the formal sector benefits from providing better public services and is negatively impacted by taxes, while the informal economy responds in the opposite way. We can say that the informal economic sector develops due to the failure of political institutions to promote an effective market economy and individuals and organizations engaged in underground production because of unsupported by efficient public services.

Unemployment: Many researches has been done to find out the causal liaison between joblessness and the underground economy. However, the answer is still unclear. An increase in unemployment will lead to an increase in the activities of the underground economy received agreement by many researchers because unemployed people have a stronger incentive to find jobs in the informal economy. Hence, the expected relationship of the impact of unemployment on the underground economy will be positive. Schneider, Buehn (2010) concludes that the unemployment rate plays an important role in influencing the size of underground economies not only in transitional countries but also in OECD countries. The same result was found by Dell'Anno (2007) for the Spanish case. However, there are also many studies showing the opposite results such as Buehn and Schneider (2008) conclude that long-term unemployment has a negative impact on the underground economy of France. However, as a whole, the positive effect of unemployment on the size of the underground economy still dominates the studies conducted to date.

The scale of agriculture: The larger the agricultural sector, the more likely it is to work in a shadow economy. The importance of agriculture is measured by the proportion of agriculture as a percentage of GDP. Agriculture plays an essential role in determining the size and development of the underground economy. Vuletin (2008) confirmed a country in which agricultural dominance will have a significant effect on the scale of the underground economy. Similarly, nearly 45% of the agricultural sector in Jamaica is conducted informally (Wedderburn et al, 2012). It is argued that the informal economy, when segmented by sectors, clearly dominates agriculture and related sectors. The reason behind maybe the concentration of informal jobs in the agricultural sector is difficult to control. Moreover, the governance capacity of local governments, especially in rural areas, creating the perfect environment for underground economic activities. The agricultural sector is difficult to control, suggesting that the higher the proportion of this sector, the greater the underground economy will be (Vuletin, 2008).

The development of the formal economy: Validated in some previous studies, the situation of the official economy also plays an essential role in the decision of workers to participate or not participate in the underground economy. (Bajada et al, 2005; Chaudhuri et al, 2006). In fact, in a strongly growing formal economy with, people will have plenty of opportunities to get a decent income. So, the probability for them to join in shadow economy will be lower. However, in the case of an economy facing recession, many people will try to offset the loss of their income from the formal economy through underground economic activity.

c) Trade Openness, Globalization and its connection to the underground economyFree trade or the openness of the economy is measured by the total value of exports and imports of GDP, which is the most commonly used indicator in empirical studies. It has the advantage of being clearly defined and clearly measured, although there are many views on whether domestic or international prices should be used to determine trade rates, as seen in the discussion of Rodrik et al (2002) on the method of measuring the economic openness used by Alcala and Ciccone (2001). Many studies using trade liberalization to answer the question of whether the countries involved in foreign trade more than whether there is economic efficiency outperformed countries exchanged less or not. A high rate of trade may be the result of a combination of policy opening, ease of access to foreign markets and a modest domestic market.

The term “globalization” emerged from the 1960s and quickly become one of the most popular used concepts in present social science. However, it is also one of the most controversial issues. Although globalization may have existed for a long time, only in the last decades has globalization made a big difference in the global political economy when it took place at an unprecedented speed and intensity. This is a topic that has attracted the attention and discussion of many scholars, so the concept of what is globalization is also very diverse. “Globalization refers above all to a dynamic and multidimensional process of economic integration whereby national resources become more and more internationally mobile while national economies become increasingly interdependent” (OECD, 2005).

The progress of science and technology had accelerated the globalization, especially in communication and the internet's role. In addition, increasingly liberal capitalism has expanded its scope of influence, which also plays an important role as countries accept deeper integration into the global economic system through free trade agreements. Especially, since the end of the Cold War, the process of globalization has more and more conditions to accelerate when the world is no longer divided into opposing economic-political blocks. Globalization process has impact on legal sphere, crime and created many challenges for the world (Tatsiy, V. Y., & Danilyan, O., 2019; Khiyavi, A., & Shamloo, B., 2019; Akhmeduev, A., 2020).

In this research, we use the data of Swiss Economic Institute for KOF Globalization Index of Vietnam, this index is an average of the indexes for Economic Globalization, Social Globalization, and Political Globalization for Vietnam. The overall index of globalization covers the economic, social, and political dimensions of globalization. Higher values denote greater globalization (Gygli et al, 2019).

It has been nearly three decades since the “Doi Moi” economic reform, as a transitional economy, Vietnam’s economy has grown at a high rate. Trade relations has been established with almost countries and territories. Vietnam is considered being one of the largest export-oriented economies in ASEAN. Part of this achievement is thanks to trade openness, particularly the free trade agreements (FTAs) that Vietnam has signed. The FTAs to which Vietnam is involved include not only the exchange of goods but also trade in services, investment and other trade-related aspects. Exporters in Vietnam have expanded export markets as well as reduced tariff and non-tariff barriers thanks to FTAs. At the end of 2017, Vietnam signed 12 FTAs, of which eight FTAs have been put into operation and are negotiating four more (16 FTAs in 2017).

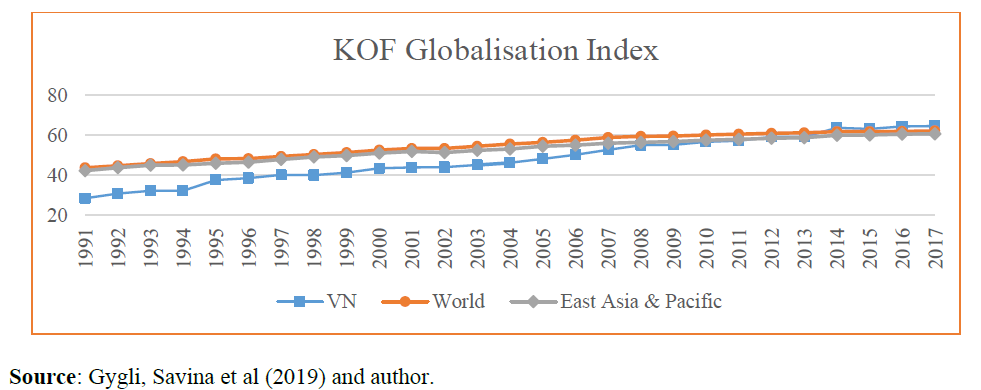

Figure 1. KOF Globalization Index of Vietnam comparing World and East Asia & Pacific.

Figure 1 shows Vietnam's efforts to integrate into the global playing field. Starting with a very low index, only half compared to the world average and East Asia & Pacific countries, Vietnam has pursued an export-oriented development policy, opening trade and making friends with all countries over the world. This effort has been successful when looking at the figure we see until 2017, the development of globalization in Vietnam has exceeded the average of the world and the East Asia & Pacific region.

The ratio of trade to GDP of a country indicates the size of the market and the openness of a country to the world. As economies grow, it is more difficult to shift economic activity from the formal to the informal sector. Moreover, as international trade increases, it will be harder to conceal trade with regulators. Another reason is to participate in import and export, which requires organizations and individuals to take part in the formal economy to meet the requirements of the importing and exporting countries. Therefore, we hypothesize that the more open a country is to trade freedom, the globalization index of that country will increase and this will lower its size of its underground economy.

H1: Does Trade openness have a positive impact on the development of globalization?

H2: Does the development of globalization will have a negative impact on the size of underground economy?

Methodology

The research uses qualitative and quantitative analysis methods. We conduct researches on underground economic research conducted in Vietnam and around the world to understand the nature and the factors affecting it. From the perspective of globalization, we then focus on the effect of trade openness to the development of globalization and analyze the relationship with the size of the underground economy by quantitative analysis. Because of limited data availability, this study focused on the period from 1991 to 2015. The dependent variable is the size of the underground economy in Vietnam, taken from the research of Medina and Schneider (2018), The authors calculated the size of the underground economy to GDP of 162 countries in the world from 1991 to 2015. With trade, the use of this representative value is similar to many previous theoretical studies of free trade such as Dowrick and Golley (2004). Data from independent variables collected from the World Bank's data source is the index of Vietnam's trade values from GDP from 1991 to 2015 - the total value of exports and imports on Vietnam's GDP, used to denote for Trade Openness. This sample corresponds to the data size of the Underground economy values. The scale of Vietnam's underground economy from Media and Schneider's research was put into Excel to illustrate graphs, then we included the data in SPSS software version 23 for regression analysis to find out the effect of the independent variable on the dependent variable. The results will contribute to the research hypothesis that does trade openness has a positive impact on the growth of globalization and does globalization has a negative impact on the size of the underground economy?

Results and discussion

a) The reality of the underground economy in Vietnam and the World.

One of the largest and most reliable studies is a study by Medina and Schneider (2018), using the MIMIC method to estimate the size of the underground economy based on the ratio of GDP to 162 countries. in the world, including Vietnam.

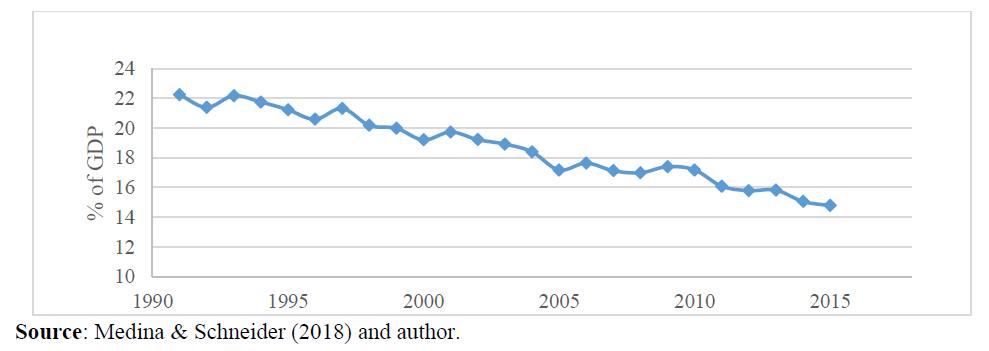

Figure 2. The size of the underground economy in Vietnam (in% of GDP)

Looking at the descriptive graph, we can see that the size of the underground economy in Vietnam is decreasing, from 22% in 1991 to 2015 at 15%. This downward trend is similar to many other countries and regions in the world.

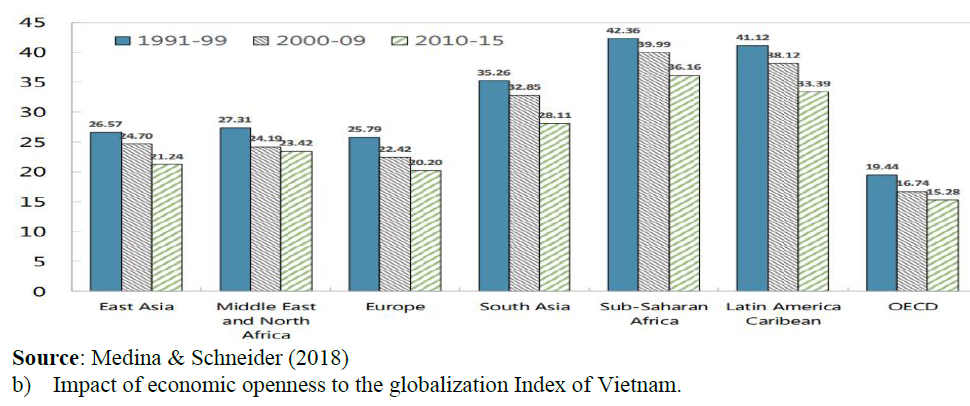

Figure 2 shows the size of the underground economy in different regions of the world over three stages, phase 1 from 1991 to 1999, phase 2 from 2000 to 2009 and phase 3 from 2010 to 2015. The region with the highest underground economic scale is sub-Saharan Africa, the economic area with the lowest underground economic scale is not surprising, the OECD countries. In addition, we can observe the similarities between regions across three stages, the scale of the underground economy in the world in many areas has witnessed a decrease.

Figure 3. Size of underground economy in regions of the world (in% of GDP)

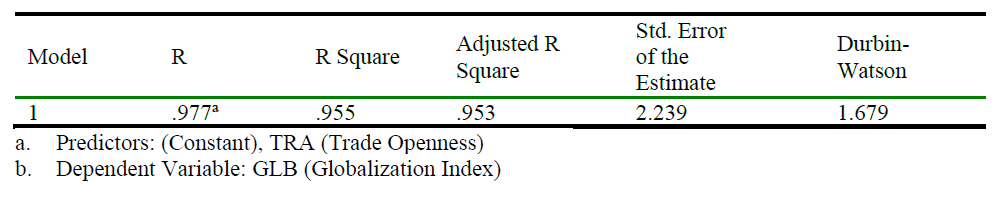

Table 1. Model Summary(b)

The Adjusted R Square value obtained is 0.953, which represents 95.3% of the variation of the dependent variable here as the development of globalization in Vietnam can be explained by the change of the independent variable–the trade openness. In addition, the Durbin-Watson value is close to 2, so there is no correlation in the first order of the model.

In the result of ANOVA analysis, we see that the reliability of the F test was 0.000 <0.05, that mean the linear regression model is consistent with the overall.

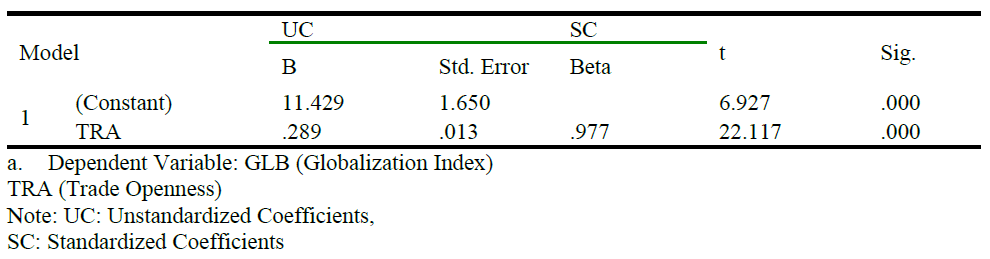

Table 2. Coefficients(a)

Regression model: GLB = 0.977 * TRA

This means that if the TRA increases by 1%, the Globalization index will increase to 0.977%.

Significance level sig = 0.000 allowed us to have the answer for H1: Trade openness do have a positive impact on the development of globalization.

c) Relationship between the development of globalization and the size of the underground economy.

After the data including the independent variable UDG (representing the size of the underground economy) and the dependent variable GLB (representing the development of globalization) is included in SPSS to run the regression model, the result obtained as follows:

Table 3. Model Summary(b)

The Adjusted R Square value obtained is 0.954, which represents 95.4% of the variation of the dependent variable here as the size of the underground economy in Vietnam can be explained by the change of the independent variable - the development of the globalization trend. In addition, the Durbin-Watson value is close to 2, so there is no correlation in the first order of the model.

Furthermore, results of ANOVA analysis showed that the reliability of the F test was 0.000 <0.05. That means the linear regression model is consistent with the overall.

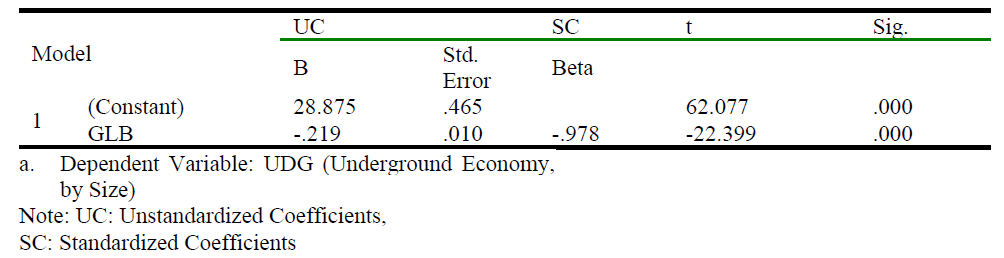

Table 4. Coefficients(a)

The significance level of the regression coefficient of the independent variable is 0.000 and less than 0.05, so this independent variable has the meaning to explain the dependent variable.

The standardized regression procedure would be:

UDG = -0.978 * GLB

The standardized coefficients Beta= - 0.978 shows that the independent variable and the dependent variable have an inverse relationship, the KOF Globalization index increases by 1% will reduce the size of the underground economy 0.978 % and vice versa. Such result is similar to many studies done around the world (Medina and Schneider, 2018; Gasparėnienė, 2016). With the significance level sig = 0.000 (<0.05), we can conclude for the hypothesis H2: The development of globalization will have a negative impact on the size of underground economy.

Conclusions

The results obtained from the study provide an empirical evidence showing the importance of trade liberalization and globalization in the impact on the size of the underground economy.

Trade openness will strongly positive impact on the degree of globalization of a country. Since that would reduce the size of the underground economy. Research has added an element not mentioned in the previous studies explaining the possible impact on the underground economy, the globalization factors. This will be the basis of reference for subsequent studies concerning underground economy topic.

While the government is promoting the implementation of measures to make the economy transparent, reduce the size of the underground economy to a manageable level, enhance international integration, and continue opening markets to enhance free trade is still an important solution to be considered. This is an important suggestion for policymakers in Vietnam in the context that many countries around the world are pursuing policies of trade protection and US-China trade war without showing signs of cooling down. In addition, the negative impact from the pandemic caused by COVID 19 will surely affect the development of globalization not only in Vietnam but also with all countries. This makes the efforts to make the economy transparent by reducing the size of the underground economy face many challenges. Therefore, policymakers need to recognize globalization in three main pillars: social, political and economic, thereby making policies to further promote the nation's global integration through these three pillars. This will partly mitigate the negative effects caused by the epidemic as in the current context. Research is still limited by only analyzing the impact of trade openness to the development of globalization and the size of the underground economy in Vietnam. In the future, other studies may continue with a larger scale of research and test the impact of other factors.